What Is a Futures Contract? Specifications, Settlement, and Examples

Navigating the world of derivatives can seem daunting, but at its core is a fundamental building block: the futures contract. For traders seeking to understand market leverage, hedging, and speculation, a clear grasp of what is a futures contract is non-negotiable. It is a legally binding agreement to buy or sell a specific asset at a predetermined price on a future date. Unlike stocks, where you own a piece of a company, a futures contract is a standardized agreement about a future transaction, facilitated and guaranteed by a regulated exchange.

This guide demystifies the futures contract, breaking down its essential components. We’ll explore the critical contract specifications that define every trade, explain the difference between physical and cash settlement, and walk through concrete examples like Crude Oil and the E-mini S&P 500. Whether you are a beginner exploring new markets or an intermediate trader refining your strategy, this article provides the foundational knowledge you need.

Definition: What Is a Futures Contract?

A futures contract is a standardized legal agreement to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future. These contracts are traded on regulated futures exchanges, like the Chicago Mercantile Exchange (CME Group). The key feature is standardization. The exchange determines the quality, quantity, delivery time, and location for each contract. This uniformity ensures that all market participants are trading the exact same thing, making the contracts fungible and easy to trade. The only variable left to be determined by the market is the price.

Futures serve two main functions:

- Hedging: Producers and consumers of a commodity can use futures to lock in a price for a future transaction, thereby protecting themselves from adverse price movements. For example, a coffee farmer can sell coffee futures to guarantee a selling price for their upcoming harvest.

- Speculation: Traders can use futures to bet on the future direction of an asset’s price. A speculator who believes the price of oil will rise can buy an oil futures contract. If they are correct, they can sell the contract later at a higher price for a profit, without ever handling a physical barrel of oil.

This dual purpose creates a deep and liquid market. For more foundational knowledge, the U.S. Commodity Futures Trading Commission (CFTC) provides an excellent overview in their Basics of Futures Trading guide.

Decoding Futures Contract Specifications

To effectively trade futures, you must understand the « specs » of the contract. These are the rules set by the exchange that define the instrument. Misunderstanding these details can lead to costly mistakes. The most critical specifications include:

- Contract Size: This defines the quantity of the underlying asset controlled by one contract. For example, a standard Crude Oil (CL) contract represents 1,000 barrels, while a Gold (GC) contract represents 100 troy ounces.

- Tick Size: The minimum price fluctuation of the contract. For the E-mini S&P 500 (ES), the tick size is 0.25 index points.

- Tick Value: The dollar value of one tick movement. It’s calculated by multiplying the tick size by the contract size. For the ES contract, a 0.25 point move is worth $12.50 (0.25 points x $50 multiplier). This is the foundation of calculating profit and loss.

- Expiration Months: Futures contracts do not exist indefinitely. They have specific expiration or delivery months. For example, equity index futures typically expire quarterly (March, June, September, December).

- Trading Hours: Most futures contracts trade nearly 24 hours a day, 5 days a week, offering traders flexibility that stock markets do not.

Understanding these specs is vital. A trader needs to know that a 10-point move in a single E-mini S&P 500 contract results in a $500 P/L change (10 points / 0.25 ticks per point * $12.50 per tick). Mastering these details is a core part of learning about Futures Trading Basics.

The Final Step: Contract Settlement Explained

When a futures contract expires, the position must be closed out through a process called settlement. There are two primary methods of settlement: physical delivery and cash settlement. The method is predetermined in the contract’s specifications.

Physical Delivery

In a physically settled contract, the seller of the contract is obligated to deliver the actual underlying commodity to the buyer. This is common for agricultural products (corn, soybeans), metals (gold, copper), and energy (crude oil). Most speculators and retail traders have no intention of taking or making delivery. For this reason, they must close or roll over their positions before the contract’s expiration period begins to avoid the delivery process. Taking delivery involves complex logistics and significant costs (storage, insurance, transportation).

Cash Settlement

Cash settlement is a much simpler process. At expiration, there is no physical exchange of goods. Instead, all open positions are « marked-to-market » one final time, and the trader’s account is credited or debited the difference between their entry price and the final settlement price. This is the standard for financial futures, such as stock index futures (S&P 500, Nasdaq 100) and interest rate futures, where delivering the underlying asset is impractical or impossible. For a deep dive into settlement mechanics, CME Group offers detailed resources on their settlement process.

| Feature | Cash Settlement | Physical Delivery |

|---|---|---|

| Mechanism | Positions are closed with a final cash credit/debit. | The underlying physical asset is delivered and received. |

| Common Contracts | E-mini S&P 500 (ES), Nasdaq 100 (NQ), Bitcoin (BTC) | Crude Oil (CL), Gold (GC), Corn (ZC), Soybeans (ZS) |

| Trader Type | Ideal for speculators and financial hedgers. | Primarily for commercial producers and consumers. |

| Logistical Burden | None. All electronic. | High. Involves storage, transport, and insurance. |

| Retail Trader Action | Can hold to expiration (though not always advised). | Must exit position before first notice day to avoid delivery. |

Practical Examples: Popular Futures Contracts

To make the concept concrete, let’s look at two of the world’s most traded futures contracts: the E-mini S&P 500 (ES) for financial futures, and West Texas Intermediate (WTI) Crude Oil (CL) for commodity futures.

E-mini S&P 500 (ES)

The ES contract allows traders to speculate on the direction of the S&P 500 stock index. It is cash-settled and highly liquid, making it a favorite of day traders and institutions alike.

- Underlying Asset: S&P 500 Index

- Exchange: CME Group

- Contract Size: $50 x S&P 500 Index value

- Tick Size / Value: 0.25 index points = $12.50

- Settlement: Cash

If a trader buys one ES contract at 4500.00 and sells it at 4510.00, their profit would be 10 points. Since each point is worth $50, the total profit is $500 (10 points * $50/point), minus commissions. The high liquidity and defined tick value make it a cornerstone for many algorithmic trading strategies.

WTI Crude Oil (CL)

The CL contract is the global benchmark for crude oil prices. It is a physically settled contract, meaning traders who hold it to expiration must be prepared to take delivery of 1,000 barrels of oil in Cushing, Oklahoma.

- Underlying Asset: West Texas Intermediate Crude Oil

- Exchange: NYMEX (part of CME Group)

- Contract Size: 1,000 barrels

- Tick Size / Value: $0.01 per barrel = $10.00

- Settlement: Physical Delivery

If a speculator buys one CL contract at $80.00 per barrel and sells it at $80.50, they have made a profit of 50 ticks. The total profit is $500 (50 ticks * $10/tick). Retail traders will always close their CL positions before the contract expires to avoid delivery.

Visual Insights: Volatility by Trading Session

Understanding when a futures market is most active is crucial for traders. The chart below illustrates the typical average volatility (measured by the Average True Range) for the E-mini S&P 500 futures across different global trading sessions. The highest volatility often occurs during the overlap of the London and New York sessions.

Figure 1: Illustrative volatility (ATR) of E-mini S&P 500 futures by session.

Key Risks and How to Manage Them

Futures trading involves substantial risk and is not suitable for all investors. The primary risk is due to leverage. Margin requirements for futures are typically a small percentage of the contract’s notional value. While this magnifies potential profits, it also magnifies potential losses. It is possible to lose more than your initial investment.

Common Mistakes to Avoid:

- Over-leveraging: Trading a position size that is too large for your account can lead to catastrophic losses from a small adverse price move.

- Ignoring Contract Expiration: Forgetting about expiration, especially for physically settled contracts, can lead to forced liquidation or an unwanted delivery obligation.

- Trading Without a Plan: Entering the market without a defined strategy, including entry/exit points and a stop-loss, is a recipe for failure. Effective risk management is paramount.

To mitigate these risks, traders must use stop-loss orders, manage their position size carefully, and have a deep understanding of the contracts they trade. For comprehensive guidance, NinjaTrader offers a practical guide on risk management basics.

Frequently Asked Questions (FAQ)

What is the main purpose of a futures contract?

A futures contract serves two primary purposes: hedging and speculation. Hedgers (like farmers or corporations) use them to lock in a future price and mitigate the risk of price fluctuations. Speculators use them to profit from correctly predicting the future direction of an asset’s price, without intending to take ownership of the underlying asset.

Are futures contracts only for commodities?

No. While futures originated with agricultural commodities like corn and wheat, today they cover a vast range of assets. This includes financial instruments like stock market indices (e.g., S&P 500), currencies (e.g., Euro), interest rates (e.g., Treasury Bonds), and even newer assets like Bitcoin.

Can a beginner trade futures contracts?

Yes, but with extreme caution. Futures are leveraged instruments, which means both gains and losses are magnified. Beginners must first gain a solid education on market mechanics, contract specifications, and risk management. Starting with Micro E-mini contracts, which have a much smaller contract size, is often recommended for those new to futures trading.

What does it mean for a futures contract to be ‘standardized’?

Standardization means that the exchange sets predefined terms for every contract. This includes the contract size (quantity of the underlying asset), quality, expiration date, and tick size (minimum price movement). This uniformity is what allows contracts to be traded interchangeably and efficiently on an exchange, as the only variable to negotiate is the price.

Conclusion: Your Next Step in Futures Trading

Understanding what is a futures contract is the first essential step toward participating in these dynamic markets. We’ve covered their definition as standardized agreements, broken down the critical specifications that govern them, and clarified the crucial distinction between cash and physical settlement. From the high-speed world of E-mini S&P 500 trading to the global economics of crude oil, futures provide unparalleled opportunities for hedging and speculation.

However, the journey doesn’t end here. The leverage inherent in futures demands discipline, continuous learning, and robust risk management. The next step is to delve deeper into practical application and strategy.

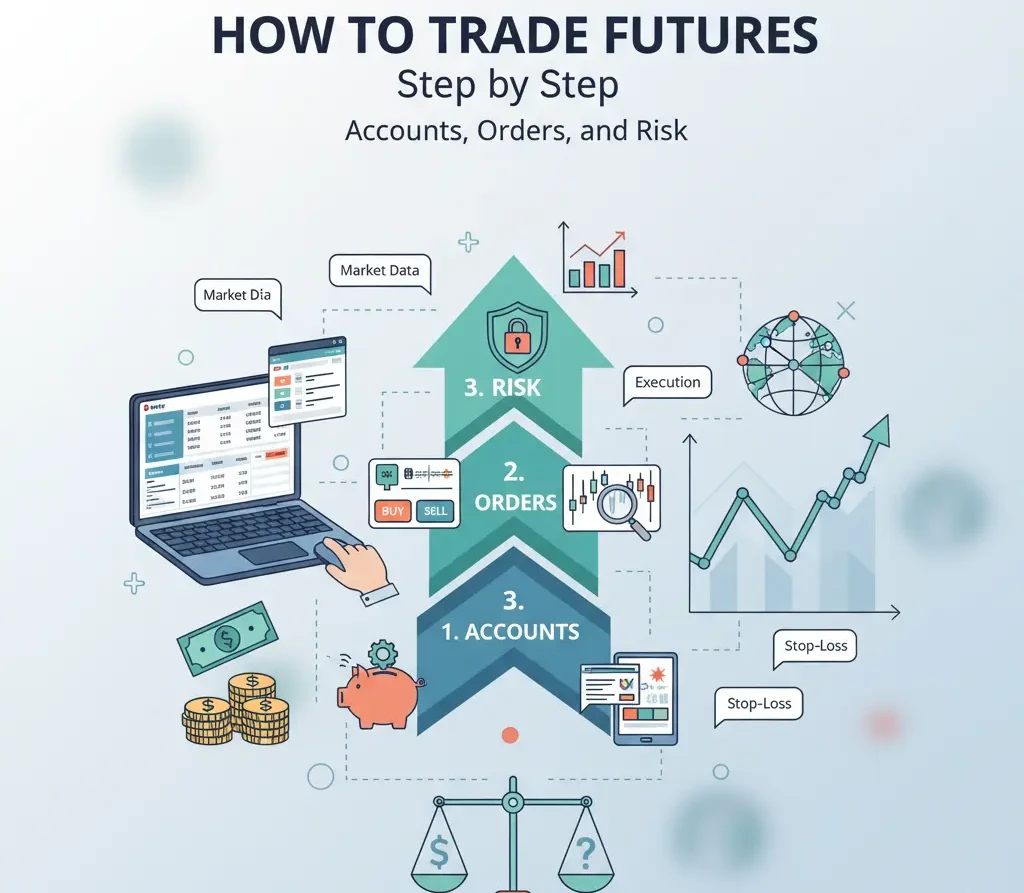

To continue building your knowledge, explore our complete guide on Futures Trading Basics to learn about market participants, order types, and setting up a trading plan.