The Allure and Pitfalls of Candlestick Reversals

Japanese candlestick patterns are a cornerstone of technical analysis for traders worldwide. Their visually intuitive shapes – the Hammers, Dojis, Engulfing patterns, and Shooting Stars – promise to signal potential market turning points, or candlestick reversals. The allure is undeniable: spot a pattern, enter a trade, and catch the beginning of a new trend.

However, any experienced trader knows it’s rarely that simple. How many times have you seen a « perfect » Hammer form, only for the market to continue its downtrend? Or a seemingly strong Bearish Engulfing pattern that fails to halt an advance? The truth is, candlestick patterns in isolation are notorious for generating false signals.

At Volume Power System, we believe the missing link, the crucial element that separates a high-probability candlestick reversal from a deceptive trap, is volume confirmation. This article will delve into why volume is the ultimate validator and how the Volume Power System (VPS) empowers you to trade these powerful patterns with far greater accuracy.

The Candlestick’s Story: Price Action and Market Psychology

Japanese candlestick patterns are powerful because they offer a snapshot of the battle between buyers and sellers over a specific period.

- A Hammer at the bottom of a downtrend, with its long lower shadow, tells a story of sellers pushing prices down, only for buyers to step in агрессивно and push prices back up near the open.

- A Bearish Engulfing pattern at the top of an uptrend shows initial buying strength being completely overwhelmed by a surge of selling pressure.

These patterns reflect shifts in market psychology. But is that shift genuine and backed by significant capital, or is it just a momentary flicker?

Volume: The Litmus Test for Candlestick Reversals

While a candlestick pattern shows what price did, volume shows how much conviction was behind that action. It reveals the level of participation and the force of the buying or selling pressure.

- High Volume = Strong Conviction: When a classic candlestick reversal pattern forms on significantly higher-than-average volume, it’s a strong indication that Smart Money (institutional investors, large funds) is actively involved. They are committing serious capital to either absorb selling pressure (at a bottom) or distribute shares (at a top). This institutional backing is what gives the reversal pattern its true power.

- Low Volume = Weak Signal / Potential Trap: If the same candlestick pattern forms on low or average volume, it’s a red flag. It suggests a lack of broad market participation and minimal institutional interest. The « reversal » might be a temporary blip caused by a few smaller players or a brief pause before the prevailing trend resumes. These are often the patterns that lead to frustrating losses.

The Volume Power System emphasizes that without volume confirmation, even the most textbook-perfect candlestick reversal pattern should be treated with extreme caution.

VPS in Action: Validating Key Candlestick Reversals with Volume

Let’s look at how the Volume Power System applies this principle to common reversal trading signals:

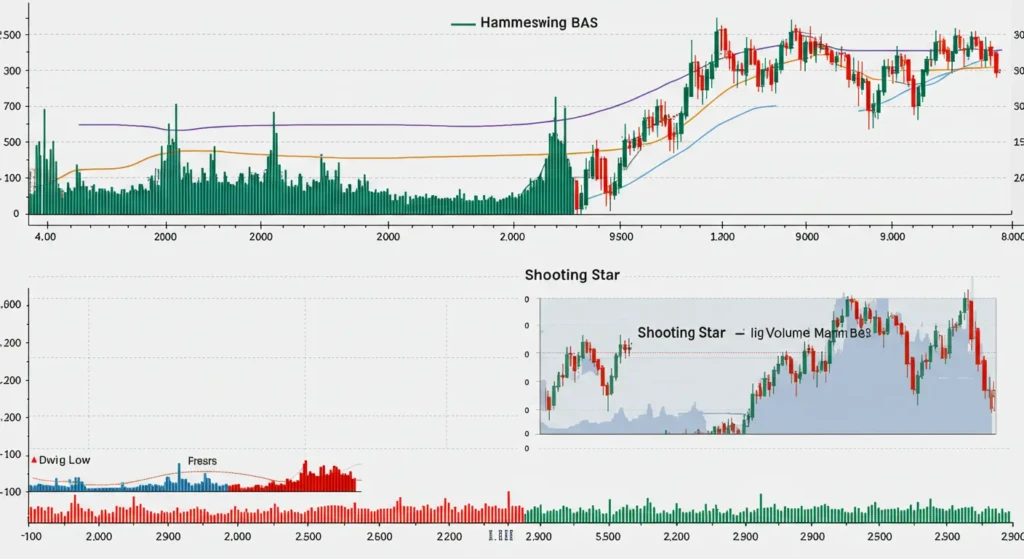

- Hammers & Shooting Stars:

- Hammer (at a low): A Hammer signals potential bullish reversal. The VPS looks for this pattern to form on a sharp increase in volume. This high volume on the Hammer indicates that strong buying pressure absorbed the selling that created the long lower shadow. It’s Smart Money stepping in to defend a level.Shooting Star (at a high): A Shooting Star signals potential bearish reversal. The VPS validates this with a significant volume spike. This means the attempt to push prices higher (long upper shadow) was met with overwhelming selling pressure from committed sellers.

- Engulfing Patterns (Bullish & Bearish):

- Bullish Engulfing (at a low): This powerful two-candle pattern is much more reliable when the large bullish engulfing candle occurs on substantially higher volume than the preceding bearish candle and recent average volume. This confirms strong buying demand overwhelming sellers.

- Bearish Engulfing (at a high): Similarly, the large bearish engulfing candle must be accompanied by a surge in volume to validate the bearish takeover and signal a high-probability reversal.

- Dojis (Especially at Extremes):

- A Doji signals indecision. When a Doji (especially a Long-Legged Doji, Dragonfly, or Gravestone) appears after a strong trend and is accompanied by unusually high volume, it indicates a fierce battle between buyers and sellers, but no clear winner yet. This high-volume indecision often precedes a significant reversal, once the next candle confirms direction (again, ideally with volume).

Beyond Single Patterns: Context and Confluence

The Volume Power System doesn’t just look at isolated patterns. The context is crucial:

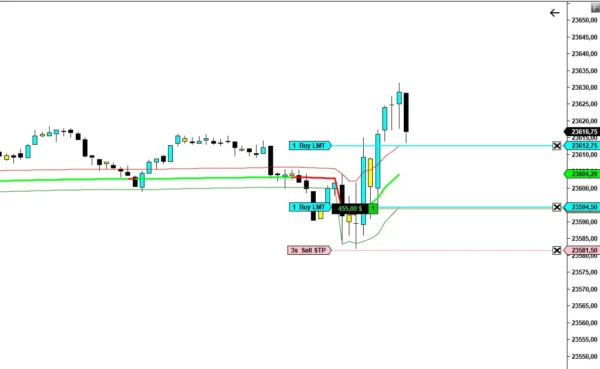

- Location Matters: A volume-confirmed candlestick reversal occurring at a key support or resistance level, a Volume Profile High Volume Node (HVN), or a significant moving average carries far more weight.

- Preceding Volume: Was the trend leading into the reversal pattern showing signs of weakening volume (divergence)? This can prime the market for a turn.

- Follow-Through: After a volume-confirmed reversal pattern, the VPS looks for follow-through price action, also ideally supported by volume, to confirm the new direction.

By combining the « what » of Japanese candlestick patterns with the « why » and « who » revealed by volume analysis, traders can dramatically improve their accuracy in identifying genuine market turning points.

Conclusion: Trade Reversals with Confidence, Not Hope

Stop relying on the mere shape of candlestick reversals. Empower your trading by demanding volume confirmation for every potential turning point. The Volume Power System provides a robust, logical framework to filter out the noise and identify the high-probability reversal signals driven by genuine market conviction and Smart Money activity.

This approach transforms candlestick trading from a game of chance into a strategic discipline, allowing you to enter reversals with greater confidence and manage risk more effectively.

Ready to master the art of identifying true candlestick reversals with the irrefutable power of volume?

GET YOUR COPY OF « VOLUME POWER SYSTEM » ON NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.