The Alluring (and Treacherous) World of Market Gaps

For futures traders, few chart events are as visually striking or as packed with potential opportunity as a market gap. A gap occurs when the opening price of a new trading session is significantly higher (gap up) or lower (gap down) than the closing price of the previous session, leaving an empty space, or « window, » on the chart.

These gaps often signal a strong shift in market sentiment, driven by overnight news, economic data releases, or a buildup of order imbalances. While trading gaps can be highly profitable, they also carry significant risk if not approached with a sound strategy. Many traders jump in impulsively, only to see the gap « fill » against them or the market continue to run without them.

At Volume Power System, we believe that the key to successfully trading gaps lies not just in recognizing their presence, but in understanding the volume dynamics that accompany them. This article will explore how the principles of the Volume Power System (VPS) can help you identify high-probability gap trading opportunities and navigate their inherent volatility.

Understanding the Different Types of Futures Gaps

Not all gaps are created equal. In futures trading, gaps can generally be categorized, and their interpretation can vary:

- Breakaway Gaps: These occur at the beginning of a new, significant trend. A breakaway gap up, for instance, signals strong buying pressure and often marks the end of a consolidation or a reversal from a downtrend.

- Volume Significance: Breakaway gaps are most powerful when accompanied by high volume, confirming strong conviction and institutional participation (Smart Money) driving the new trend.

- Continuation Gaps (or Runaway Gaps): These occur during an established trend, in the direction of that trend. They signal a fresh surge of interest and often indicate that the trend is likely to continue with momentum.

- Volume Significance: Continuation gaps should also ideally occur on above-average volume, though it might not be as extreme as a breakaway gap. This confirms ongoing commitment to the trend.

- Exhaustion Gaps: These occur near the end of a strong trend and often signal a final, unsustainable push before a reversal. A gap up on high volume after a long uptrend, followed by a reversal and a close below the gap, can be a classic exhaustion signal.

- Volume Significance: Exhaustion gaps often occur on very high, climactic volume. This represents the last wave of enthusiastic (often retail) buyers or panicked sellers, with Smart Money potentially taking the other side of the trade.

- Common Gaps: These are smaller gaps that tend to occur in ranging or less volatile markets and are often « filled » (price returns to close the gap) relatively quickly.

- Volume Significance: Common gaps usually occur on average or low volume, indicating less conviction and making them less reliable for directional trading.

The Volume Power System Edge: Trading Gaps with Confirmation

The Volume Power System emphasizes that a gap, in itself, is just a price event. Its true trading significance is revealed by the volume that creates it and the volume that follows.

Here’s how VPS principles apply to trading gaps in futures markets like E-mini futures or Nasdaq futures:

- Volume Confirmation of the Gap Itself:

- High-Conviction Gaps: A gap (especially breakaway or continuation) that occurs on significantly higher-than-average volume on the opening bar or the first few bars of the new session is a strong indication of genuine institutional intent. This is where Smart Money is making its move.

- Low-Volume Gaps: A gap that occurs on low or average volume is less reliable. It might be due to temporary illiquidity or a news event that hasn’t garnered strong institutional follow-through. These gaps are more likely to fill.

- Post-Gap Volume Analysis: What happens after the gap is equally crucial.

- Trend Continuation: If a gap up occurs on high volume, and subsequent price action continues higher on sustained (or even increasing) volume, it confirms the strength of the bullish sentiment.Gap Fill Indication: If a gap up occurs, but subsequent attempts to push higher are met with declining volume, or if selling volume picks up significantly as price tries to hold the gap, it increases the probability of the gap being filled.

- « Gap and Go » vs. « Gap Fill » Strategies:

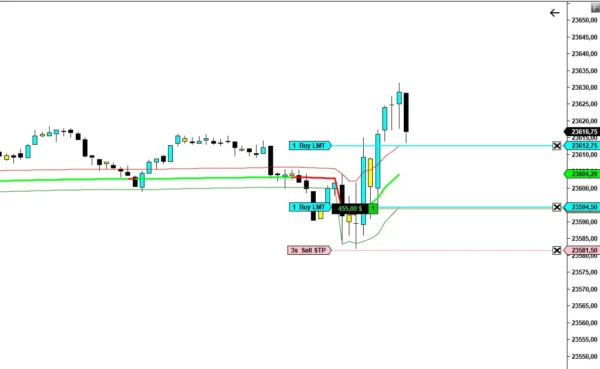

- « Gap and Go »: The VPS looks for high-volume breakaway or continuation gaps where the initial momentum is strong. Entry might be considered on a small pullback after the initial thrust, with stops placed strategically below the gap or a key support level formed post-gap.

- « Gap Fill »: If a gap occurs on low/average volume, or if post-gap volume analysis suggests a lack of follow-through, the VPS might identify opportunities to trade for a « gap fill. » This involves looking for signs of reversal (e.g., specific candlestick patterns with confirming volume) that indicate price is likely to return and close the gap.

- Using Gaps as Support/Resistance:

- Once a significant gap (especially a breakaway or runaway gap on high volume) occurs, the price levels defining the gap (the previous close and the new open) can become important psychological and technical support (for a gap up) or resistance (for a gap down). The VPS watches for how price and volume interact when these levels are retested.

Navigating News-Driven Gaps in Futures

Many gaps in futures trading, particularly in commodities or indices like Nasdaq futures, are driven by scheduled economic releases (e.g., Non-Farm Payrolls, EIA Crude Oil Inventories) or unexpected geopolitical events.

- Initial Reaction vs. True Move: The initial gap on news can be very volatile. The VPS advises patience, waiting to see how the volume develops after the initial spike. Is there sustained institutional buying/selling, or was it just a short-term reaction that will fade?

- The « Fade the News » Strategy with Volume Confirmation: Sometimes, a news-driven gap overextends. If the gap occurs on massive initial volume but then fails to find follow-through, and volume on counter-trend moves starts to pick up, it could signal an opportunity to « fade » the initial move, anticipating a partial or full gap fill.

Trade Gaps with Clarity, Not Guesswork

Trading gaps in futures markets can be a powerful addition to your arsenal, but only if approached with a robust methodology that incorporates more than just price. By understanding the different types of gaps and, crucially, by analyzing the volume that accompanies and follows them, the Volume Power System provides a framework for identifying high-probability gap trading opportunities.

Stop treating gaps as random events. Learn to read the Smart Money’s intentions within these powerful market signals and trade with the clarity and conviction that volume provides.

Ready to master the art of trading futures gaps with a proven, volume-based system?

GET YOUR COPY OF « VOLUME POWER SYSTShopEM » ON NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.