Order Flow is the engine of the market where professional traders, hedge fund managers, and institutional investors find their edge. In the sophisticated arena of financial markets, where multi-million dollar decisions are made in microseconds, this perpetual quest for an advantage is won not on the surface of price charts, but by understanding the flow of buy and sell orders. Mastering Order Flow is paramount, and its integration into a trading methodology like the Volume Power System can be the difference between alpha generation and lagging returns. This article delves into the critical role of Order Flow analysis, the tools required for its mastery, and its practical application for professional traders.

Decoding the Market’s Intent with Order Flow Analysis

At its core, Order Flow trading is the analysis of the real-time flow of buy and sell orders to predict future price movements. Unlike traditional technical analysis that relies on historical price and volume, order flow analysis focuses on the immediate actions of market participants. For institutional traders, this is not just data; it is a live transcript of market sentiment and intention. By dissecting this flow, one can discern the aggressive buying and selling pressure that actually moves the market, rather than just the passive limit orders that wait to be filled.

This microscopic view into market dynamics allows traders to identify crucial areas of support and resistance, assess liquidity, and gauge the conviction behind price movements. It moves beyond lagging indicators to provide a real-time, nuanced understanding of supply and demand imbalances.

The Professional’s Toolkit for Order Flow Trading

To effectively harness the power of Order Flow, a specialized set of tools is required. These instruments provide a granular view of the transactions occurring, offering insights that are invisible on a standard candlestick chart.

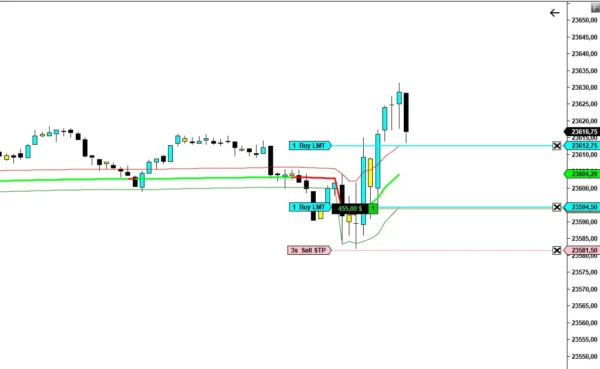

- Depth of Market (DOM): Also known as the order book, the DOM displays the number of buy and sell limit orders at different price levels. It is a primary tool for assessing market liquidity and identifying potential price pressure. A significant imbalance, for instance, with many more buy orders than sell orders, can suggest upward price pressure.

- Volume Profile: This powerful tool displays trading activity over a specified time period at various price levels. It highlights where the most significant trading has occurred, revealing crucial support and resistance zones that are respected by institutional players. For a deeper dive into our proprietary methods, you can explore our methodology at Volume Power System Methodology.

- Footprint Charts: These charts offer an even more detailed perspective, showing the volume of executed buy and sell orders at each specific price level within a bar. This allows traders to pinpoint where aggressive buyers or sellers are stepping in, confirming or denying the strength of a price move.

- VWAP (Volume-Weighted Average Price): A benchmark rather than a tool, the VWAP is crucial for institutional traders who need to execute large orders without significantly impacting the market. Trading with the order flow below VWAP for buys and above for sells is a common institutional strategy.

For a comprehensive overview of the tools we recommend, please see our Trading Tools Explained page.

Integrating Order Flow into Your Trading System

For speculators and professional traders, the application of order flow analysis is about identifying high-probability entry and exit points. For example, when the market approaches a key support level identified by the Volume Profile, a trader can watch the Order Flow via footprint charts and the DOM. If large sell orders are being absorbed by aggressive buyers without the price breaking down, it signals strong buying interest and a potential entry point.

This data-driven approach removes emotional decision-making and aligns the trader with the real forces of the market. To learn more about advanced trading strategies, Investopedia offers a wealth of information.

Frequently Asked Questions (FAQ)

How does order flow analysis work?

Order flow analysis involves observing the real-time stream of buy and sell orders to gauge market sentiment and anticipate short-term price movements. Traders use tools like the Depth of Market (DOM) to see pending orders and footprint charts to see executed trades at each price level, identifying supply and demand imbalances.

What is the significance of the order book in trading?

The order book, or DOM, is highly significant as it provides a transparent view of market liquidity and depth. It displays all the visible buy and sell limit orders, allowing traders to see where potential support and resistance levels are forming based on the concentration of orders.

Can you use order flow on stocks?

Yes, order flow analysis is highly effective for stocks, especially in markets with a centralized exchange. Because stock exchanges consolidate order information, they provide a clear and comprehensive view of the order flow, making it an excellent market for this type of analysis. For further reading on stock analysis, see MarketWatch.

Discover the Volume Power System and transform your approach to the markets today.

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.