The Market’s Hidden Game and the Smart Money’s Hand

The market often feels like a riddle, a complex dance of supply and demand where only the most astute truly understand the rhythm. While price charts tell us what happened, they rarely reveal why or who was behind the significant moves. This is where the concept of Smart Money becomes crucial.

Smart Money refers to the large, informed institutional players – hedge funds, investment banks, large private equity firms – whose capital flows are substantial enough to influence market direction. Unlike retail traders, their entry and exit from positions cannot be hidden. Instead, their actions leave unmistakable « footprints » on the chart, primarily visible through volume.

At Volume Power System, we believe that mastering the art of reading these volume footprints, particularly during phases of accumulation and distribution, is paramount to gaining a true trading edge. This article will demystify these critical market phases and show how the VPS empowers you to trade alongside the powerful forces that move the markets.

Beyond Price: Why Volume Reveals True Intent

Many traders focus exclusively on price action – candlestick patterns, support/resistance, trend lines. While these are vital, they only show the result, not the underlying conviction. A price move on low volume is fundamentally different from the same price move on high volume.

Volume is the measure of participation and interest. When Smart Money is actively involved, they exchange vast numbers of contracts, creating noticeable spikes and patterns in the volume bars. This makes volume the most reliable indicator of institutional intent. It tells us:

- Conviction: Is the move backed by serious capital, or just speculative chatter?

- Absorption: Are large players buying up all available supply (accumulation) or selling into strong demand (distribution)?

- Liquidity: Are sufficient orders being executed to sustain the price move?

By understanding these dynamics, we begin to see the market as a battlefield where Smart Money carefully positions itself, often long before the broader market reacts.

Volume Accumulation: Smart Money Buying Stealthily

Volume accumulation is the market phase where Smart Money is actively buying and building long positions, typically after a significant downtrend or within a consolidation range. This process isn’t about chasing prices higher; it’s about systematically absorbing supply from retail traders who are panicking, frustrated, or simply losing hope.

Characteristics of Volume Accumulation:

- Price Behavior: The price tends to form a base, often oscillating within a defined range. Downtrends might show signs of slowing momentum, with price making lower lows but on decreasing volume.

- Volume Footprints:

- Selling Climax: Often, the very bottom of a downtrend will be marked by a large spike in volume on a bearish candle. This represents panic selling from « weak hands » being absorbed by Smart Money.

- Tests of Lows: Subsequent attempts by sellers to push prices lower will be met with decreasing volume. This indicates that the supply is drying up; the Smart Money has already bought most of what was available at lower prices.

- High Volume on Rallies: Short, sharp rallies within the accumulation range might occur on relatively higher volume, indicating Smart Money entering or testing the market’s response.

- Consolidation Volume: Overall, the volume during the consolidation phase might be below average, with intermittent spikes when Smart Money is active, followed by quiet periods.

The Smart Money uses these periods of accumulation to acquire large positions at favorable prices, preparing for the next upward move.

Volume Distribution: Smart Money Selling Strategically

Volume distribution is the opposite phase, where Smart Money is actively selling and liquidating their long positions, typically after a significant uptrend or within a topping range. Here, the goal is to offload large blocks of shares to enthusiastic retail buyers who are often driven by FOMO (Fear Of Missing Out) or euphoria.

Characteristics of Volume Distribution:

- Price Behavior: The price tends to form a top, often oscillating within a defined range. Uptrends might show signs of slowing momentum, with price making higher highs but on decreasing volume (indicating exhaustion).

- Volume Footprints:

- Buying Climax: The peak of an uptrend can be marked by a large spike in volume on a bullish candle. This signifies the last wave of buying from « weak hands » being met by massive selling from Smart Money.

- Tests of Highs: Subsequent attempts by buyers to push prices higher will be met with decreasing volume. This indicates that demand is drying up; the Smart Money has already sold most of its positions at higher prices.

- High Volume on Dips: Short, sharp dips within the distribution range might occur on relatively higher volume, indicating Smart Money selling into any remaining strength.

- Consolidation Volume: Similar to accumulation, the overall volume during the distribution range might be below average, but with key spikes corresponding to Smart Money activity.

The Smart Money uses these distribution periods to exit their positions with maximum profit, anticipating the next downward movement.

The Volume Power System Advantage: Decoding Smart Money with Precision

The Volume Power System transcends simple volume interpretation by integrating these principles with advanced candlestick analysis and market context. It provides a structured approach to:

- Validate Candlestick Patterns: A bullish reversal candlestick (like a Hammer or Bullish Engulfing) appearing at the low of an accumulation range, especially with confirming high volume, is exponentially more powerful than one without Smart Money backing. Similarly for bearish patterns at the high of a distribution range.

- Identify Confluence Zones: VPS teaches you to recognize when these volume footprints occur at key support or resistance levels, making them even more significant.

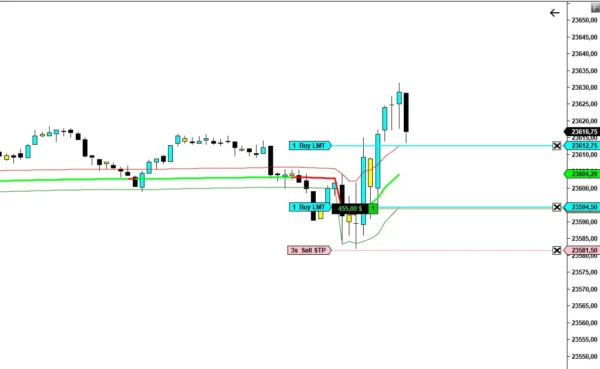

- Anticipate Breakouts: By consistently observing the drying up of supply during accumulation or demand during distribution, the VPS prepares you for the high-conviction breakout that typically follows these phases. When the price finally breaches the range with a surge in volume, it’s a confirmed move driven by Smart Money.

- Avoid Traps: The system helps you distinguish genuine Smart Money activity from retail « chasing » or manipulation, protecting you from common fakeouts.

Understanding volume accumulation and distribution is not just academic; it’s a direct window into the actions of the most powerful players on the market. It allows you to position yourself strategically, minimizing risk and maximizing potential returns.

Conclusion: Trade with Insight, Trade with Volume Power System

The market is a constant battle between buyers and sellers, but the Smart Money often dictates the terms. By learning to read their footprints through meticulous volume analysis during accumulation and distribution phases, you gain an invaluable strategic advantage.

The Volume Power System provides you with the framework to interpret these subtle yet profound signals, transforming your understanding of market dynamics from guesswork to informed decision-making. Stop reacting to price and start anticipating the moves of the true market movers.

Are you ready to unlock the secrets of Smart Money and elevate your trading to a professional level?

GET YOUR COPY OF « VOLUME POWER SYSTEM » NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.