The Nasdaq’s Allure and the Volatility Challenge

The Nasdaq 100 Index, home to the titans of technology and innovation, is a magnet for traders worldwide. Its underlying futures contracts, particularly the Nasdaq Futures (NQ!), offer incredible liquidity and the potential for substantial gains, driven by the rapid growth and dynamic shifts within the tech sector.

However, the very characteristic that makes Nasdaq Futures so attractive – its high volatility – also makes it one of the most challenging markets to navigate. Rapid price swings, sudden reversals, and explosive breakouts can quickly turn profitable positions into significant losses for the unprepared. Traditional futures trading strategies often struggle to keep pace with this dynamism, leaving many traders overwhelmed by the noise.

At Volume Power System, we believe that understanding volatility is not about taming it, but about decoding it. This article will explain how the Volume Power System (VPS) leverages the unparalleled clarity of volume data to cut through the noise, providing a precise methodology for Nasdaq futures analysis and trading with conviction.

Why Nasdaq Volatility Demands a Volume-Based Approach

Unlike slower-moving assets, Nasdaq Futures can experience dramatic price shifts in a short timeframe. This rapid acceleration and deceleration require a deeper understanding than simple price action can provide. This is where volume becomes your indispensable guide:

- Confirming Direction: In volatile markets, price can « fake out » frequently. A strong move might look convincing on a price chart, but without matching volume, it lacks genuine institutional backing. VPS teaches you to discern real momentum from speculative noise.

- Identifying True Intent: The sheer speed of Nasdaq movements often masks the true intent of Smart Money. Volume, however, reveals where significant capital is being committed, helping you identify high-conviction moves driven by large players.

- Cutting Through Noise: Volatility generates a lot of « noise » – small, erratic price fluctuations. Volume acts as a filter, allowing you to focus on the moments when serious activity is occurring, making your Nasdaq futures analysis far more effective.

While E-mini futures trading on the S&P 500 (ES!) also benefits from volume analysis, the amplified volatility of Nasdaq Futures makes volume an even more critical component for precise entry and exit.

VPS Principles for Mastering Nasdaq Futures Volatility

The Volume Power System employs specific principles to transform Nasdaq’s volatility from a challenge into an opportunity:

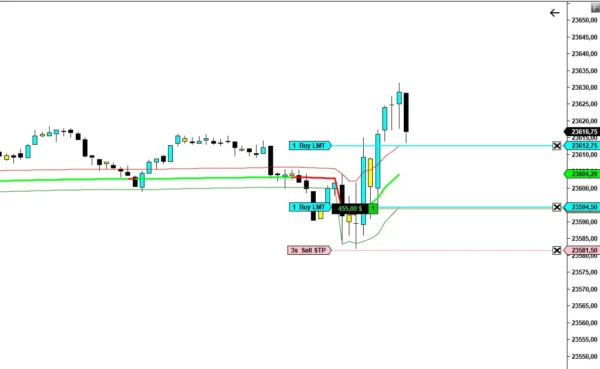

- High-Conviction Breakouts with Volume Confirmation:

- Nasdaq Futures are famous for their breakouts. But how do you know which ones are real? The VPS looks for a decisive price breach of a significant level (resistance or support) that is accompanied by a substantial surge in volume. This volume spike confirms the presence of Smart Money conviction, differentiating a genuine breakout from a costly fakeout. A weak volume breakout on Nasdaq is a clear warning sign.

- Decoding Smart Money’s Footprints: Accumulation & Distribution in High-Beta Stocks:

- Given Nasdaq’s correlation with leading tech stocks, understanding institutional positioning is key. The VPS helps identify volume accumulation (where institutions are buying heavily during consolidation or dips) and volume distribution (where they are selling into rallies). On Nasdaq, these phases might be quicker, but the volume signatures remain clear, indicating when large players are preparing for major directional shifts.

- Volatility Absorption & Climax Volume:

- In extreme volatile swings, a sudden, massive spike in volume at an extreme price point (e.g., a low after a sharp drop, or a high after a steep rally) indicates volatility absorption. This is often Smart Money stepping in to absorb all available supply (at a low) or overwhelming demand (at a high). This « climax volume » often signals an exhaustion of the move and a potential reversal. For Nasdaq futures analysis, these signals are invaluable for pinpointing significant turning points.

- Leveraging Volume Profile for Dynamic Support/Resistance:

- In highly volatile markets, static support/resistance lines can be quickly breached. Volume Profile offers a dynamic view. The VPS uses Volume Profile on Nasdaq Futures to identify areas where the most trading activity occurred (High Volume Nodes – HVN) or where price moved quickly through (Low Volume Nodes – LVN). HVNs often act as strong magnetic zones or reversal points for Nasdaq, providing more reliable levels in fast markets.

Implementing Your VPS Nasdaq Futures Strategy

Applying the Volume Power System to Nasdaq Futures requires discipline and precision:

- Focus on Key Timeframes: While VPS principles are universal, Nasdaq futures trading often thrives on shorter timeframes (e.g., 5-minute, 15-minute charts) where volume signals can be incredibly potent for intraday moves.

- Rigorous Risk Management: Given Nasdaq’s volatility, meticulous position sizing and stop-loss placement (as detailed in the Volume Power System book) are non-negotiables. Never over-leverage.

- Confluence of Signals: The true power of the VPS lies in the confluence of strong candlestick patterns, confirming volume, and understanding market context (like Order Flow, which the book delves into).

- Adaptability: While the principles remain constant, Nasdaq futures analysis requires constant vigilance and adaptation to evolving market conditions.

The Volume Power System provides a framework that allows you to confidently engage with Nasdaq’s volatility, transforming it from a source of fear into a wellspring of trading opportunities. While this article focuses on Nasdaq, the principles are universally applicable to broader futures trading strategies, commodity futures outlook, and even forex futures trading, giving you a versatile edge.

Conclusion: Command Your Nasdaq Trades with Volume Power System

The allure of Nasdaq Futures is undeniable, but so is its challenge. By embracing the clarity and predictive power of volume, as taught by the Volume Power System, you gain the tools to navigate its volatility with unmatched precision. Stop chasing price and start understanding the true conviction that drives the market.

Empower your Nasdaq futures analysis with the system designed to reveal the Smart Money’s hand. The Volume Power System isn’t just another strategy; it’s a fundamental shift in how you perceive and profit from the markets.

Ready to transform your Nasdaq Futures trading and gain a definitive edge?

GET YOUR COPY OF « VOLUME POWER SYSTEM » NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.