In the high-stakes arena of financial markets, volume is a double-edged sword. For many, a surge in volume is a clear green light—a confirmation of a breakout, a sign of conviction, a reason to jump into a trade. Yet, for institutional traders and hedge fund managers, this very surge is often a carefully orchestrated tool of deception. This is the world of liquidity traps, where high volume is used not to confirm a move, but to engineer one for the benefit of « smart money. »

Understanding the nuances of smart money flow is what separates consistently profitable professionals from the retail crowd. It’s the ability to look at a high-volume candle and ask not « Is this strong? » but « Who is this volume for? ». This article dissects the anatomy of liquidity traps, reveals how institutional players manipulate price with volume, and provides advanced strategies for professionals to navigate these deceptive market environments.

The Mechanics of Deception: Unpacking the Smart Money Flow

At its core, smart money flow refers to the capital deployed by institutional investors, central banks, and other large-scale financial players. Due to the sheer size of their orders, they cannot simply buy or sell at will without causing significant price slippage. Their primary challenge is accumulating or distributing large positions without alerting the market.

This is where liquidity traps are born. These are not random market events; they are engineered zones designed to accomplish one goal: to trigger a flood of orders from retail and uninformed traders.

Here’s the typical sequence:

- Accumulation/Distribution: An institution quietly builds a large position in a tight range, often on low volume to avoid detection.

- Engineering the Breakout: They then push the price decisively through a well-known technical level (e.g., a daily high or a key resistance). This push is often accompanied by a dramatic spike in volume.

- Trapping the Herd: This high-volume breakout triggers two sets of orders: stop-losses from traders on the wrong side and new buy orders from enthusiastic breakout traders. This creates a massive pool of liquidity.

- The Reversal: With a wealth of counterparties to trade against, the institution can now easily fill the rest of its intended position, absorbing the retail orders and driving the price sharply in the opposite direction. The breakout traders are now trapped.

For a deeper dive into the foundational theories behind these market phases, the Wyckoff Method provides a comprehensive framework that has been studied by professionals for decades.

Key Signatures of an Engineered Liquidity Trap In Smart Money Flow

Recognizing a liquidity trap before it springs requires moving beyond simplistic volume analysis. It demands a sophisticated understanding of the relationship between price action, volume, and market context.

Context is Everything: Price at Key Levels

Volume is meaningless without location. A high-volume spike in the middle of a range is noise. However, a massive volume surge right at a multi-week high or a critical psychological level ($100, $1000) should immediately raise suspicion. Smart money operates at levels where the maximum number of stop-losses and breakout orders are clustered.

The Anomaly of Volume Spread Analysis (VSA)

Instead of confirming strength, high volume can often signal an impending reversal. A classic VSA tell is an « Upthrust » or « No Demand » bar:

- High Volume, Narrow Spread: The price pushes to a new high on a massive volume spike but closes near the middle or low of the candle. This indicates that a huge supply of sell orders met the buying pressure, « absorbing » the breakout attempt.

- Low Volume at New Highs: After an initial push, subsequent attempts to move higher occur on progressively weaker volume. This signals a lack of genuine institutional interest in higher prices.

Understanding these volume-price relationships is fundamental. The Volume Power System concept is built around decoding these institutional footprints to distinguish genuine moves from engineered traps.

Absorption and Exhaustion Prints

Advanced order flow tools can reveal large market orders being « absorbed » at a key price level without the price moving significantly. This is a clear sign of a large player holding the line. Conversely, a climax in volume, known as exhaustion, often marks the end of a move as the last of the emotional traders jump in right at the top.

Strategies for Professional Traders and Fund Managers

To avoid being the liquidity, traders must learn to think and act like the institutions setting the traps.

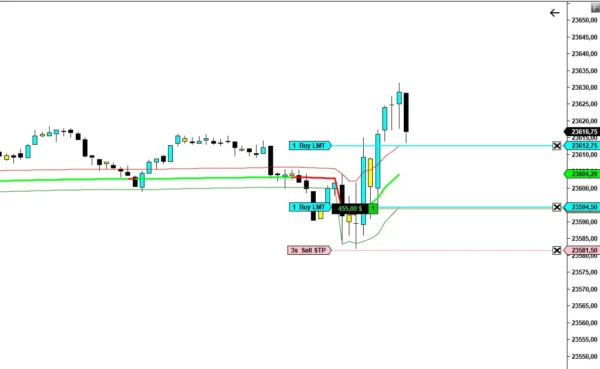

- Fade the Obvious: Treat obvious, high-volume breakouts at well-known levels with extreme skepticism. The more perfect a setup looks, the higher the probability it is engineered.

- Wait for Confirmation: The professional’s entry is not on the breakout but on the failed breakout. Wait for the price to reverse back into the previous range and look for an entry on the retest of that breakdown level. This confirms the trap has been sprung.

- Master Advanced Volume Interpretation: Simple volume bars are not enough. A professional methodology is required to translate volume data into actionable intelligence. For those dedicated to mastering these skills, the ‘Volume Power System’ book offers a complete manual for deploying a strategy based on this deeper understanding of market forces.

FAQ: Navigating Smart Money Flow and Liquidity

How do you identify a smart money trap?

Look for a combination of factors: a high-volume breakout at a very obvious technical level, followed by a price reversal back into the range. The key is the failure of the breakout to sustain momentum despite the high volume.

Is high volume always bullish on a breakout?

No, and this is a critical misconception. High volume can be « churning » volume, where a massive number of buy orders are being met with an equally massive number of sell orders from institutional players. It often signals absorption and an impending reversal, not confirmation.

How do institutions manipulate price with volume?

They use volume to create a « story » that entices other traders. By executing a large buy order, they can create a spike in volume that looks like a strong breakout. This triggers herd behavior, providing the liquidity they need to distribute an even larger position at a favorable price. As the U.S. Securities and Exchange Commission (SEC) notes, a significant portion of trading occurs off-exchange, allowing institutions to mask their initial intentions.

What is the difference between retail and smart money?

The primary difference is motive and scale. Retail traders react to price movements. Smart money causes price movements to facilitate their large-scale operations. Retail sees a breakout and chases it; smart money creates the breakout to sell into it.

Conclusion

For the hedge fund manager, professional speculator, or serious educator, volume is the market’s most honest data point—if you know how to read it. The high-volume events that trap the majority are the very signals that can illuminate the path for the informed professional. By abandoning simplistic interpretations and embracing a deeper understanding of smart money flow, traders can learn to see liquidity traps not as a threat, but as a high-probability opportunity to trade alongside the market’s most powerful forces. The volume doesn’t lie; you just have to learn its language.

Your Path to Mastering Smart Money Flow

The theory is clear, but the application is what generates alpha. The constant challenge of distinguishing a genuine market move from a sophisticated liquidity trap requires more than just knowledge—it requires a systematic, repeatable methodology.

This is precisely the problem the Volume Power System was engineered to solve.

It offers the ideal and unique solution in the world for this problem, providing a complete framework dedicated to systematically decoding institutional volume signatures in real-time. This system is designed to move you from being a reactor to market noise to becoming a proactive strategist who can anticipate these traps and leverage them for profit.

Stop trading on hope and start operating with institutional-grade intelligence.

➡️ Discover the Volume Power System and transform your approach to the markets today.

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.