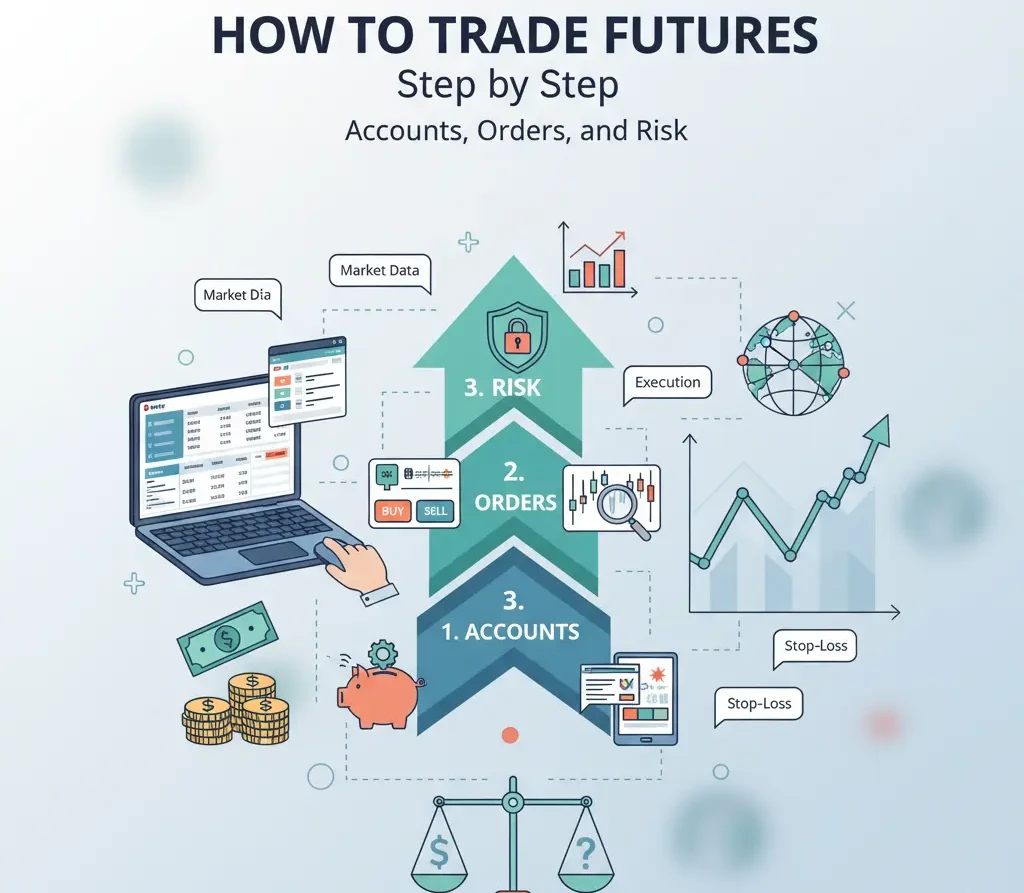

How to Trade Futures Step by Step: Accounts, Orders, and Risk

Diving into the world of derivatives can feel overwhelming, but learning how to trade futures is a manageable process when broken down into clear, actionable steps. Futures contracts, which are standardized agreements to buy or sell an asset at a future date and price, offer traders opportunities in various markets, from commodities to stock indices. This guide provides a comprehensive framework for beginners and intermediate traders, covering everything from opening your first account and understanding essential order types to implementing robust risk management. Unlike stock trading, futures involve significant leverage, which can amplify both gains and losses. Therefore, a solid educational foundation is not just beneficial—it’s essential for navigating these dynamic markets successfully.

1. What Are Futures Contracts? Core Concepts

A futures contract is a legally binding agreement to buy or sell a specific asset at a predetermined price on a specified date in the future. These contracts are standardized by the exchange they trade on, meaning each contract for a particular asset has the same specifications for quantity, quality, and expiration. For example, a single E-mini S&P 500 futures contract always represents $50 times the S&P 500 index value.

Traders use futures for two primary purposes:

- Hedging: Producers or consumers of a commodity use futures to lock in a price and protect themselves against adverse price movements. For instance, a corn farmer might sell futures contracts to guarantee a selling price for their upcoming harvest.

- Speculation: Most retail traders are speculators. They aim to profit from price fluctuations without intending to take physical delivery of the underlying asset. A speculator might buy S&P 500 futures if they believe the stock market will rise.

The key concepts to grasp are margin and leverage. Margin is not a down payment but a good-faith deposit required to open and maintain a futures position. Because this margin is typically a small percentage of the contract’s total value, futures offer high leverage. While this can lead to substantial profits, it equally amplifies losses, making it a double-edged sword that demands respect and careful management.

2. Step-by-Step Guide to Your First Futures Trade

Learning how to trade futures involves a structured approach. Following these steps can help you build confidence and navigate the markets with a clear plan.

- Educate Yourself: Before risking any capital, understand the fundamentals. Learn the terminology, contract specifications for the markets you’re interested in, and the mechanics of margin. For a solid foundation, check out resources like the CFTC’s Basics of Futures Trading guide.

- Choose a Market: There are futures contracts for nearly every asset class, including indices (S&P 500, Nasdaq), commodities (oil, gold), currencies, and bonds. Beginners often start with highly liquid markets like the E-mini S&P 500 (ES) or Micro E-mini contracts due to their tight spreads and high volume.

- Develop a Trading Plan: Your plan is your roadmap. It should define your strategy, including your entry and exit criteria, risk-reward ratio, and position sizing rules. A crucial part of this is deciding what type of analysis (technical, fundamental) you will use. Exploring different Algorithmic Trading Strategies can provide inspiration for rule-based approaches.

- Open a Futures Trading Account: Select a reputable futures broker and complete their application process. You will need to be approved for futures trading, which often involves acknowledging the risks.

- Practice with a Simulator: Nearly all brokers offer a demo or paper trading account. This is a critical step. Practice executing your trading plan in a simulated environment to get comfortable with the platform’s order entry system and to test your strategy without financial risk.

- Fund Your Account and Start Small: Once you are consistently profitable in the simulator, you can fund your live account. Start with a small position size, such as a single micro contract, to manage risk while you acclimate to live market conditions.

- Monitor and Manage Your Position: After entering a trade, monitor it according to your plan. Use stop-loss orders to define your maximum acceptable loss. Always stick to your exit rules, whether the trade is a winner or a loser.

3. Essential Tools and Account Setup

To trade futures effectively, you need the right tools and a properly configured setup. This goes beyond just having a funded account; it involves choosing a platform and data feed that align with your trading style.

Choosing a Broker and Platform

Your choice of broker is critical. Look for firms with competitive commissions, low margin requirements, excellent customer support, and a robust trading platform. Many brokers offer proprietary platforms, while others provide access to third-party software like NinjaTrader or TradingView. When selecting a platform, consider:

- Execution Speed: Fast and reliable order execution is paramount, especially for short-term traders.

- Charting Capabilities: The platform should offer advanced charting tools, indicators, and drawing tools to support your analysis.

- Order Types: Ensure it supports a full range of order types, including advanced options like OCO (One-Cancels-the-Other).

- Data Feeds: A high-quality, real-time data feed is non-negotiable. Delayed or inaccurate data can lead to poor trading decisions.

After selecting a broker, the account opening process typically involves an online application where you provide personal and financial information and acknowledge the risks of futures trading. Platforms like NinjaTrader provide extensive documentation on setting up and using their order entry tools.

4. Understanding Futures Order Types

Proper order placement is crucial for executing your strategy and managing risk. While there are many complex order types, mastering the fundamentals is the first step. Different orders give you control over the price and timing of your trade’s execution.

Core Order Types Explained

Here’s a breakdown of the most common orders every futures trader must know:

- Market Order: An instruction to buy or sell at the best available current price. It guarantees execution (a fill) but not the price. Use it when speed is more important than the exact price.

- Limit Order: An order to buy or sell at a specific price or better. A buy limit is placed below the current market price, and a sell limit is placed above. It guarantees the price but not execution.

- Stop Order (or Stop-Market Order): An order that becomes a market order once a specific price level (the « stop price ») is reached. A buy stop is placed above the market, and a sell stop is placed below. It is commonly used to limit losses on an open position or to enter a trade on a breakout.

| Order Type | Purpose | Price Certainty | Execution Certainty |

|---|---|---|---|

| Market Order | Immediate entry or exit | Low (fills at next available price) | High (almost always fills) |

| Limit Order | Enter/exit at a specific price or better | High (fills only at your price or better) | Low (may not fill if price isn’t reached) |

| Stop-Market Order | Limit losses or enter on momentum | Low (triggers a market order, slippage possible) | High (fills once triggered) |

| Stop-Limit Order | Limit losses with price control | Medium (converts to a limit order) | Low (may not fill in fast markets) |

Understanding these distinctions is fundamental. For example, using a market order in a volatile, low-liquidity market could result in significant « slippage »—where your fill price is far from the price you expected. This is why many disciplined traders prefer limit orders for entries and stop orders for risk control.

5. Critical Risk Management Strategies

Risk management is arguably the most important skill in learning how to trade futures. Due to leverage, a single trade can result in significant losses without a proper plan. Effective risk management is not about avoiding losses entirely—which is impossible—but about ensuring they are small and manageable.

The Pillars of Futures Risk Control

- The 1% Rule: A widely adopted guideline is to never risk more than 1% of your trading capital on a single trade. If you have a $10,000 account, your maximum loss on any given trade should be no more than $100. This helps you survive a string of losses.

- Use Stop-Loss Orders: Every trade should have a pre-defined stop-loss order. This is your « line in the sand » that automatically exits the trade if the market moves against you by a certain amount. It removes emotion from the decision to cut a loss.

- Position Sizing: Your position size—how many contracts you trade—should be determined by your stop-loss distance and your 1% rule. If your strategy on the ES futures contract requires a 4-point stop ($200 risk per contract), and your 1% risk is $100, you are risking too much. You would need to trade a micro contract or find a trade setup with a tighter stop.

- Understand Your Risk-Reward Ratio: Only take trades where the potential profit is significantly greater than the potential loss. A common target is a 1:2 or 1:3 risk-reward ratio. This means for every $100 you risk, you are aiming to make $200 or $300. This is a core concept for anyone serious about using Volume Profile in Futures to identify high-probability setups.

By combining these principles, you create a defensive framework that protects your capital, allowing you to stay in the game long enough to become consistently profitable. For more advanced reading, Tastytrade offers an excellent guide on futures risk management.

Visualizing Market Activity: Volatility by Session

Understanding when a market is most active can be crucial for your strategy. Different trading sessions (Asia, London, New York) exhibit different volatility characteristics. The SVG chart below illustrates a hypothetical example of volatility for the E-mini S&P 500 futures across sessions.

Frequently Asked Questions (FAQ)

How much money do I need to start trading futures?

The minimum capital required to trade futures varies by broker and the type of contract. For ‘micro’ contracts, some brokers allow accounts with as little as a few hundred dollars. For standard E-mini contracts, it’s common to need a few thousand dollars to cover initial margin requirements and manage risk effectively.

Can beginners trade futures?

Yes, beginners can trade futures, but it is crucial to start with comprehensive education. Due to the high leverage, futures carry substantial risk. New traders should begin with a demo or paper trading account to practice strategies and understand market dynamics without risking real capital.

Are futures trading and stock trading the same?

No, they are fundamentally different. When you trade stocks, you are buying a share of ownership in a company. When you trade futures, you are buying or selling a standardized contract to exchange an asset at a predetermined future date and price. Futures trading involves significant leverage and has different margin rules and expiration dates.

What is ‘leverage’ in futures trading?

Leverage in futures allows you to control a large contract value with a relatively small amount of capital, known as margin. This magnifies both potential profits and potential losses, making risk management a critical component of any futures trading plan.

Your Next Step in Futures Trading

You now have a foundational, step-by-step roadmap for how to trade futures. The journey from novice to proficient trader is built on education, disciplined practice, and unwavering risk management. Remember that success is not measured by single wins but by long-term consistency. The key is to combine a solid understanding of market mechanics with a robust trading plan that you can execute without emotion.

As you continue your education, the next logical step is to delve deeper into the core principles of the market. To build on what you’ve learned here, we highly recommend reading our guide on Futures Trading Basics to solidify your understanding.