Introduction: The Elusive Breakout and the Hidden Hand

The promise of a market breakout—a swift, decisive move out of a trading range is one of the most enticing prospects for any trader. It signals the potential beginning of a strong trend, offering substantial profit opportunities. Yet, for every true breakout that delivers, countless others turn into frustrating « fakeouts, » trapping unsuspecting traders and leading to rapid losses. The critical question isn’t just if a price breaks out, but how it breaks out. What separates the high-conviction moves from the market noise?

The answer lies in understanding the Smart Money. These are the institutional investors, the large hedge funds, and the well-capitalized professional traders who possess the deep pockets and sophisticated insights to truly move markets. Their actions leave an unmistakable footprint, not just in price, but more significantly, in volume.

At Volume Power System, we believe that by meticulously combining Japanese candlestick analysis with an unparalleled focus on volume, traders can gain a profound edge. This article will delve into how the Volume Power System (VPS) empowers you to identify high-conviction breakouts by decoding the subtle yet powerful signals of Smart Money.

The Illusion of the « Fakeout »: Why Most Breakouts Fail

Traditional technical analysis often teaches us to simply look for a price crossing a key resistance or support level. While this is a necessary condition, it’s far from sufficient. Many retail traders fall prey to fakeouts because they overlook the qualitative aspect of the breakout – the conviction behind the move.

A common scenario: price pushes marginally above a resistance level, triggering buy orders from breakout traders. However, if this move lacks genuine institutional backing, the price often swiftly reverses, pulling back into the previous range. This traps the breakout buyers, who are then forced to liquidate their positions, often exacerbating the reversal. The missing ingredient in these failed breakouts is the Smart Money’s participation.

Smart Money’s Footprint: The True Power of Volume

Smart Money doesn’t operate by chasing small price moves. They manage vast sums of capital, and their entry or exit from a market requires significant liquidity. When these large players accumulate or distribute positions, they leave a distinct signature in the form of volume.

- Volume as Conviction: High volume indicates strong participation and genuine conviction. When Smart Money is entering a position, they need to buy (or sell) large quantities, which translates directly into elevated trading volume.

- Volume as Validation: Price movements without corresponding volume are suspect. They suggest a lack of real interest or simply the actions of less informed traders. Smart Money validates a move by putting serious capital behind it.

- Volume as Liquidity Absorption: Smart Money doesn’t just buy; they absorb supply. At key turning points or before a major breakout, they might accumulate shares, soaking up selling pressure, or distribute shares, overwhelming buying pressure. This absorption process is clearly reflected in volume patterns.

The Volume Power System is designed to precisely identify these fingerprints, allowing you to trade with the Smart Money, rather than being caught on the wrong side of their moves.

The VPS Edge: Identifying High-Conviction Breakouts Driven by Smart Money

A high-conviction breakout, from a Volume Power System perspective, is not just a price penetration of a level; it’s a decisive price move backed by significant, confirming volume, indicating Smart Money’s undeniable commitment.

Here’s what we look for:

- Consolidation Phase with Diminished Volume: Before a breakout, markets often consolidate within a tight range. Crucially, the volume during this consolidation should ideally be low or decreasing. This signifies a period of indecision, where neither buyers nor sellers are asserting dominance with strong conviction. It’s a quiet period before the storm, often where Smart Money accumulates or distributes quietly.

- The Breakout Candlestick: The candle that finally breaches the resistance (for a bullish breakout) or support (for a bearish breakout) must be strong.

- Bullish Breakout: A long, full-bodied bullish candlestick (e.g., a Bullish Marubozu or a similar strong closing candle) that closes decisively above the resistance level.

- Bearish Breakout: A long, full-bodied bearish candlestick that closes decisively below the support level.

- The Volume Confirmation: This is where the VPS truly shines. The breakout candle must be accompanied by a significant surge in volume. This volume bar should be noticeably higher than the average volume during the preceding consolidation phase, and ideally, one of the highest volume bars in recent history. This is the Smart Money’s declaration of intent. They are putting their capital to work to push the price in the desired direction.

Decoding Smart Money’s Intention: Volume Power System in Action

The Volume Power System applies these principles to provide clear, actionable signals:

- Absorption Breakouts: Sometimes, Smart Money may absorb all selling pressure at a support level, creating a volume spike on a reversal candlestick (like a Hammer on high volume). When the price then breaks a short-term resistance, if this is confirmed by further strong volume, it signals a high-conviction move initiated by prior accumulation.

- Continuation Breakouts: In established trends, brief consolidations might occur. When the price breaks out of such a consolidation in the direction of the trend, a confirming volume surge indicates that Smart Money is re-engaging to push the trend further.

- Low Volume Traps: Conversely, the VPS teaches you to be wary of breakouts on low volume. These are often signs of retail « chasing » without institutional backing, making them prime candidates for failure and trapping those who enter without confirmation.

By understanding the relationship between price, candlesticks, and especially the volume accompanying every move, the Volume Power System allows you to differentiate between mere market noise and genuine Smart Money activity, providing a robust framework for identifying high-conviction breakouts.

Beyond the Breakout: Managing Your High-Conviction Trades

Identifying a high-conviction breakout is the first step; managing it is the next. The Volume Power System also incorporates principles for effective trade management:

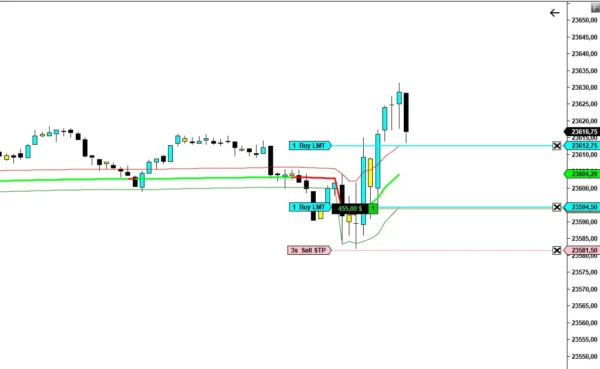

- Strategic Stop-Loss Placement: Your stop-loss should be placed logically, often below the low of the breakout candle or just outside the consolidation range, giving the trade room to breathe but limiting potential losses if the confirmed breakout fails.

- Profit Targeting: Utilize key resistance/support levels, Volume Profile high-volume nodes, or specific VPS exit signals to determine your profit targets, aiming for favorable risk-to-reward ratios.

- Scaling: As the Smart Money continues to push the price, the VPS can also guide you on how to scale into positions or implement trailing stops to protect profits.

Conclusion: Trade with Conviction, Trade with Volume Power System

The days of guessing which breakout will succeed are over. By mastering the art of reading volume in conjunction with price action, you unlock a profound understanding of Smart Money’s true intentions. The Volume Power System provides you with the framework to make more informed, higher-probability trading decisions.

Don’t let valuable opportunities slip through your fingers due to a lack of conviction or misinterpretation of market signals. Elevate your trading by learning to discern the true force behind market movements.

Are you ready to revolutionize your trading and gain a definitive edge by truly understanding the Smart Money?

GET YOUR COPY OF « VOLUME POWER SYSTEM » NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.