The Unavoidable Twist in Futures Trading

For anyone involved in futures trading, the concepts of futures expiration and rollover are not just technicalities; they are critical market events that can significantly impact price action and trading opportunities. During these periods, liquidity shifts, open interest migrates, and volatility can spike as traders close out old positions and establish new ones in the next contract month.

Ignoring or misunderstanding these dynamics can lead to costly mistakes. Conversely, a professional trader who knows how to interpret the signals during futures expiration and rollover, especially through the lens of volume confirmation, can find unique advantages.

At Volume Power System, we believe that volume holds the key to deciphering true market intent, even during the « noisy » rollover period. This article will explain what happens during futures expiration and rollover and how the Volume Power System (VPS) helps you navigate these transitions with greater clarity and confidence.

What is Futures Expiration?

Every futures contract has a specific expiration date. This is the last day the contract can be traded. After this date, the contract ceases to exist, and settlement occurs. Settlement can be:

- Physical Delivery: For many commodity futures (like crude oil, grains, metals), the seller is obligated to deliver the physical commodity, and the buyer is obligated to take delivery. Most speculators aim to avoid this.

- Cash Settlement: For many financial futures (like E-mini futures trading on stock indices or forex futures trading), the contract is settled in cash based on the difference between the contract price and the underlying asset’s price at expiration.

For speculators, the primary goal is to close out their positions before the expiration date to avoid the complexities of delivery or the final settlement process.

What is Futures Rollover?

As one contract month approaches its futures expiration, traders who wish to maintain their exposure to that market must « roll over » their positions. This involves:

- Closing out their position in the expiring (front-month) contract.

- Simultaneously opening a new position in a contract with a later expiration date (the next active, or back-month, contract).

This rollover process typically occurs over several days or weeks leading up to the front-month’s expiration. The period with the most active rolling is often referred to as « rollover week. »

Why Rollover Periods Can Be Volatile (and How Volume Helps)

Rollover periods are characterized by several market dynamics that can create both opportunities and challenges:

- Shifting Liquidity and Open Interest: As traders roll, volume and open interest gradually shift from the expiring contract to the next contract month. This can lead to decreased liquidity in the front month as it nears expiration, potentially causing wider spreads and more erratic price moves.

- Arbitrage Activity: Professional traders engage in arbitrage between the expiring contract and the next contract, trying to profit from small price discrepancies. This can add to the volume and short-term volatility.

- Price Gaps: Often, there’s a price difference (a « gap ») between the expiring contract and the next active contract due to factors like carrying costs (for commodities) or interest rate differentials.

- Increased « Noise »: The sheer volume of orders related to closing, opening, and rolling positions can create a lot of « noise » on the charts, making it harder to discern true directional intent based on price alone.

This is where volume confirmation becomes indispensable.

- Volume in the Expiring Contract: As expiration nears, if you see significant volume spikes on directional moves in the expiring contract, it might indicate large players either aggressively closing out positions or, less commonly, attempting a last-minute manipulation. Be wary of initiating new positions here unless the VPS signals are exceptionally clear.

- Volume in the Next Active Contract: This is where the real insight lies. Volume building up strongly in the next active contract on directional moves confirms that Smart Money is establishing their positions for the coming period. This is a critical signal for your ongoing futures trading strategies.

The Volume Power System Edge During Expiration and Rollover

The Volume Power System (VPS) provides a structured approach to navigating these periods:

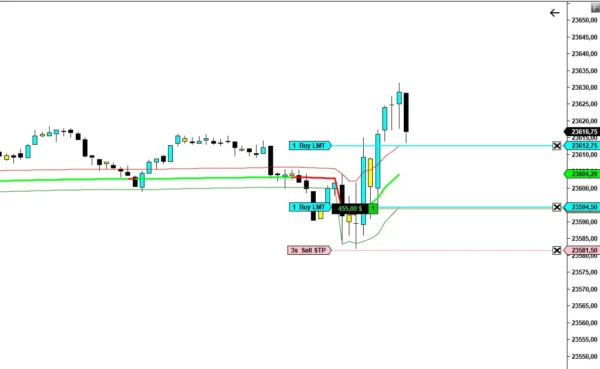

- Focus on the Dominant Contract: VPS emphasizes trading the contract with the highest volume and open interest. During rollover, this focus gradually shifts from the expiring month to the next active month. Pay attention to when the volume in the back month consistently surpasses the front month – this is often the signal that the « roll » is well underway for institutions.

- Volume Confirmation for New Positions: If you are looking to initiate a new position based on your broader Nasdaq futures analysis or commodity futures outlook, the VPS insists on volume confirmation in the new contract month. A breakout or reversal pattern in the new contract, backed by strong volume, indicates genuine institutional interest for that upcoming period.

- Identifying True Sentiment vs. Rollover Noise: Large volume spikes can occur simply due to the mechanical process of rolling. The VPS helps differentiate this from volume that indicates a new directional bias. For example, if the market is trending up and, during rollover, the new contract shows strong volume on up-moves and weaker volume on pullbacks, it confirms the bullish sentiment is carrying over.

- Managing Risk: Rollover periods can be choppy. The VPS’s inherent risk management principles (clear stop-loss placement, appropriate position sizing) are even more critical. Avoid getting caught in low-liquidity « squeezes » in the expiring contract.

Understanding how Smart Money behaves during futures expiration and rollover is a key component of professional futures trading strategies. They are not just passively rolling; they are often strategically positioning themselves. Volume is your window into these actions.

Conclusion: Trade Rollovers with Clarity, Not Confusion

Futures expiration and rollover are integral parts of the futures trading landscape. Instead of viewing them as periods of mere confusion, learn to see them as periods rich with information, provided you know where to look. By focusing on volume confirmation in the appropriate contract month, the Volume Power System allows you to cut through the noise, identify true institutional intent, and position yourself effectively for the next market phase.

Don’t let rollover periods disrupt your trading. Empower yourself with the clarity that volume provides.

Ready to master every phase of the futures market, including expiration and rollover, with a proven system?

GET YOUR COPY OF « VOLUME POWER SYSTEM » ShopNOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.