The Unpredictable Giant – Why Crude Oil Demands a Deeper Look

Crude Oil Futures – the lifeblood of the global economy – are among the most dynamic and often volatile instruments traded in financial markets. From geopolitical tensions and OPEC decisions to global economic forecasts and inventory reports (like EIA and API), the price of oil can swing wildly, creating both immense opportunities and significant risks.

For professional traders navigating these complex waters, traditional commodity trading strategies based solely on price action often fall short. The sheer volume of news, speculation, and institutional maneuvering can create confusing signals. This is where volume analysis, especially through the lens of the Volume Power System (VPS), offers an unparalleled advantage.

At Volume Power System, we believe that understanding the true force behind Crude Oil Futures movements isn’t about predicting news, but about decoding the footprints of Smart Money. This article will explain how volume reveals the critical supply and demand imbalances that truly drive oil prices, empowering you with a more precise approach to crude oil futures trading.

The Fundamental Drivers: Supply & Demand in Crude Oil Futures

Unlike many financial assets, Crude Oil Futures are directly tied to tangible, physical supply and demand dynamics. Understanding these forces is paramount:

- Supply Factors: OPEC+ production cuts/increases, non-OPEC output (e.g., US shale), geopolitical disruptions (wars, sanctions), inventory levels (weekly EIA/API reports).

- Demand Factors: Global economic growth, industrial activity, transportation needs, seasonal variations.

These factors create a constant push and pull on prices. However, knowing about these factors isn’t enough. You need to know how the market is reacting to them – and that’s where volume comes in.

The Volume Advantage: Tracking Smart Money in the Energy Market

Smart Money in the Crude Oil Futures market includes not just large speculators (hedge funds), but also commercial hedgers (oil producers, refiners, airlines) who use futures to manage their risk. These entities trade in massive quantities, and their actions are directly reflected in the volume data.

- Confirming Conviction: When news hits the crude oil futures outlook, price might react sharply. But is it a lasting move, or just a knee-jerk reaction? A genuine price surge or plunge, backed by high volume, confirms that large, committed capital is behind the move, indicating Smart Money conviction in the new direction.

- Revealing Absorption/Distribution: Smart Money needs liquidity to execute their large orders without drastically moving the market against them. They often use periods of consolidation or smaller swings to accumulate (buy up supply) or distribute (sell into demand). These stealthy operations are clearly visible as volume accumulation or volume distribution patterns.

- Spotting Exhaustion: After a prolonged rally or slump in Crude Oil Futures, volume can signal the end of the line. A climax volume event (a massive volume spike at an extreme price) often indicates that the last panicked buyers or sellers have entered, and Smart Money is reversing their position, absorbing the market’s final push.

For any commodity trading strategy, relying on unfiltered price action without volume confirmation is like driving blind through a dense fog.

VPS in Action: Decoding Crude Oil Futures with Volume

The Volume Power System leverages the exceptional transparency of Crude Oil Futures volume data to provide clear, actionable insights:

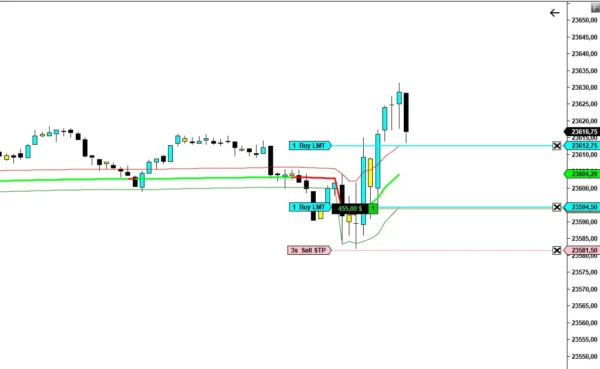

- Identifying High-Conviction Breakouts: When oil prices break out of a consolidation range or a key technical level (like $70 or $80 per barrel), the VPS meticulously checks the accompanying volume. A significant volume spike on the breakout candle confirms Smart Money participation, indicating a high-probability move rather than a mere « fakeout » that often plagues less experienced traders.

- Tracking Institutional Accumulation and Distribution: The VPS guides you in identifying periods where commercial hedgers or large speculators are quietly building or unloading positions. For instance, a series of relatively smaller bullish candles with increasing volume on dips during a base-building phase in Crude Oil Futures can signal accumulation. Conversely, declining volume on rallies at a top, followed by a high-volume bearish candle, might indicate distribution.

- Confirming Reversals with Climax Volume: In the highly emotional crude oil futures market, sharp reversals often occur. The VPS focuses on climax volume – a sudden, massive volume bar at a major price extreme. This signals that the market has either reached peak panic (selling climax) or peak euphoria (buying climax), and Smart Money is stepping in to absorb the remaining orders, often leading to a sharp reversal.

- Leveraging Volume Profile for Key Price Levels: Volume Profile (often accessible for futures) provides a horizontal histogram of volume by price level. For Crude Oil Futures, this is invaluable. It helps identify « High Volume Nodes » (HVNs) where Smart Money has done a lot of business, acting as strong support/resistance zones. A breakout through a « Low Volume Node » (LVN) in oil tends to be fast, as there’s less resistance.

Beyond the Headlines: A Systematic Approach to Crude Oil Futures Trading

Relying solely on headlines or economic reports for your crude oil futures outlook is a high-risk gamble. While fundamentals drive long-term trends, volume provides real-time confirmation of how Smart Money is interpreting and acting on that information.

The Volume Power System equips you with a systematic methodology to:

- Filter out market noise and focus on high-probability setups.

- Validate the strength and conviction of price moves in Crude Oil Futures.

- Position yourself strategically alongside the most powerful market participants.

Whether you’re looking for short-term opportunities or a broader commodity trading strategy, integrating authentic volume analysis through the VPS will significantly enhance your decision-making and performance.

Conclusion: Trade Crude Oil with Unmatched Clarity

The Crude Oil Futures market is a force to be reckoned with, but it’s not indecipherable. By learning to read the precise language of volume, you gain a unique insight into the underlying supply and demand dynamics and the strategic movements of Smart Money.

The Volume Power System provides the essential framework for crude oil futures trading with unparalleled clarity and conviction. Stop reacting to the market’s volatility and start anticipating its true direction.

Ready to transform your Crude Oil Futures trading with the power of volume?

GET YOUR COPY OF « VOLUME POShopWER SYSTEM » NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.