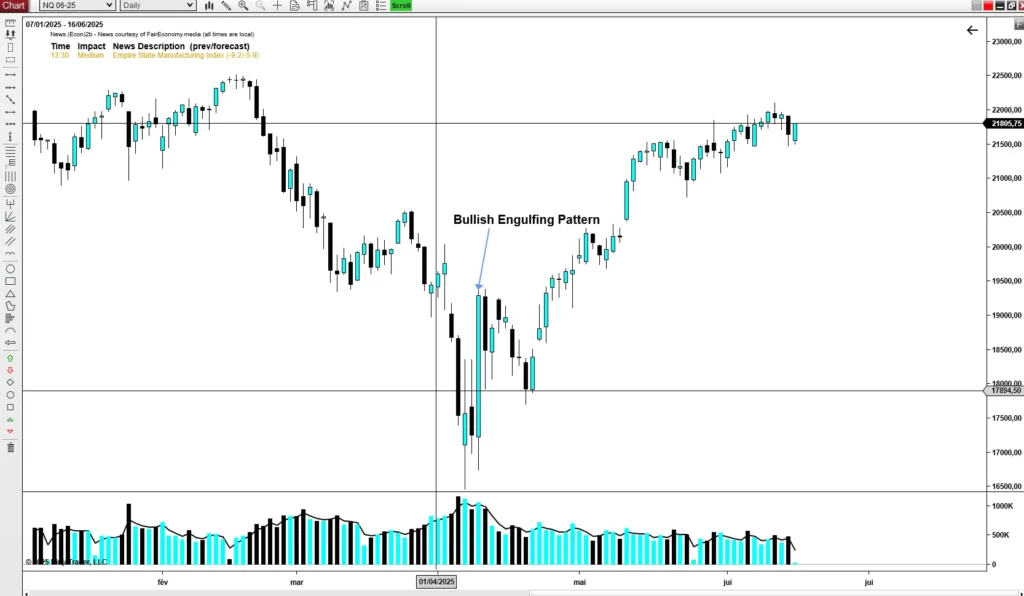

What Is the Bullish Engulfing Pattern?

A bullish engulfing pattern is a powerful two‑candlestick reversal signal. It occurs when a small bearish (red/black) candle is completely overshadowed by a larger bullish (green/white) candle This shift typically forms at the tail end of a downtrend—especially when preceded by four or more red candles .

The Bullish Engulfing Pattern is one of the most recognized and visually compelling signals in a trader’s arsenal. When you see a small bearish candle completely « engulfed » by a larger bullish candle at the bottom of a downtrend, it sends a powerful message: the buyers have returned with overwhelming force. It’s a classic sign of a potential bottom and the start of a new uptrend.

But let’s be honest. How many times have you jumped into a trade based on this « perfect » pattern, only to see the market hesitate and then resume its downward march, leaving you with a loss and a dent in your confidence?

The reason so many Bullish Engulfing Patterns fail is simple: they lack the single most important ingredient for confirmation – volume. At Volume Power System, we teach that a pattern’s shape is only half the story. This article will show you how to « reimagine » the Bullish Engulfing Pattern by validating it with the irrefutable power of volume, turning a hopeful signal into a high-conviction trading setup.

The Classic Bullish Engulfing Pattern: A Quick Refresher

Before we enhance it, let’s recap the classic definition. A Bullish Engulfing Pattern is a two-candle reversal pattern that forms after a downtrend and consists of:

- Candle 1: A bearish (red/black) candlestick.

- Candle 2: A larger bullish (green/white) candlestick that opens lower than the previous candle’s close and closes higher than its open, completely engulfing the body of the first candle.

The psychology is clear: sellers were in control, but a massive wave of buying pressure emerged, completely reversing the sentiment within a single period. This is a classic candlestick reversal pattern. But was this wave of buying a genuine tidal wave of Smart Money, or just a temporary ripple?

The Critical Flaw: The Volume Void

The primary reason traders get trapped by this pattern is by ignoring the context of participation. A pattern can form with very few participants, making it a weak and unreliable signal.

- A Low-Volume Engulfing Pattern: If the large bullish candle forms on low or average volume, what does it really tell us? It suggests that while buyers did win the session, there was no significant commitment of capital. It could be a short-squeeze or a lack of sellers rather than aggressive, new buying. This is a « hollow » signal, prone to failure.

- A High-Volume Engulfing Pattern: This is where the story changes. When the engulfing candle is backed by a surge in volume, it’s a powerful statement. It signifies that large players – the Smart Money – have stepped in with conviction. They are not just testing the waters; they are actively absorbing all available supply and initiating new long positions.

This distinction is the core of the Volume Power System’s approach to price action trading.

The VPS Perspective: The Anatomy of a High-Probability Bullish Engulfing

To be considered a high-conviction signal by the Volume Power System, a Bullish Engulfing Pattern must meet a strict volume criteria.

The Golden Rule: Volume Confirmation

The large, bullish engulfing candle must form on significantly higher-than-average volume. This volume bar should dwarf the volume of the recent candles, especially the preceding bearish candle.

Let’s break down the ideal scenario:

- The Context (Downtrend): The pattern appears after a clear downtrend. Ideally, the volume during the final stages of this downtrend might be decreasing, showing seller exhaustion.

- Candle 1 (The Bearish Candle): This candle should ideally have low to average volume. This reinforces the idea that the selling pressure is waning. There is little conviction left in the downtrend.

- Candle 2 (The Bullish Engulfing Candle): This is the moment of truth. The volume here must explode. This surge confirms that the reversal isn’t just a passive event but an aggressive takeover by powerful buyers. This is the Smart Money making its presence known.

Confluence: Where to Find the Most Powerful Bullish Engulfing Patterns

Context is everything. A volume-confirmed Bullish Engulfing Pattern is even more powerful when it forms at a logical, technically significant location:

- At a Key Support Level: When the pattern forms at a major horizontal support level, a previous swing low, or a key moving average, it shows that buyers are defending that level with force.

- After a Selling Climax: If the downtrend ends with a massive volume spike (a selling climax), a subsequent volume-confirmed Bullish Engulfing Pattern is a very strong signal that the bottom is likely in.

- With Bullish Volume Divergence: If price was making lower lows while volume was declining, this « divergence » already hinted at seller weakness. A Bullish Engulfing Pattern with high volume in this context acts as the final confirmation.

How to Trade the Volume-Confirmed Bullish Engulfing Pattern

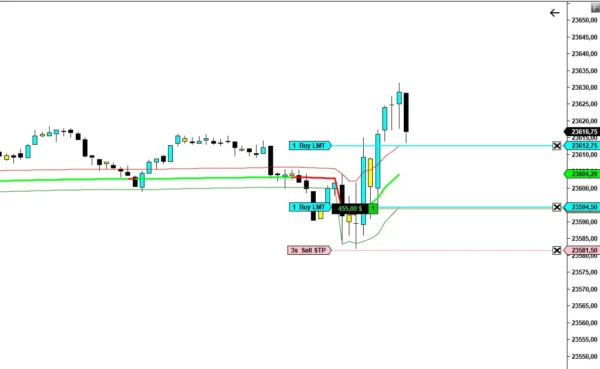

Once you’ve identified a high-probability setup according to VPS principles:

- Entry: A common entry is at the open of the next candle, confirming the pattern’s strength. More aggressive traders might enter near the close of the engulfing candle itself.

- Stop-Loss: A logical stop-loss is placed just below the low of the engulfing candle, providing a clear invalidation point.

- Targets: Look to the next key resistance levels, Volume Profile nodes, or use a favorable risk-to-reward ratio to set profit targets.

By demanding this layer of volume analysis, you filter out the vast majority of weak signals and focus only on the Bullish Engulfing Patterns that have the backing of institutional capital.

Conclusion: Trade Patterns with Conviction, Not Just Shape

The Bullish Engulfing Pattern is a powerful tool, but only when you learn to distinguish between a hollow shape and a signal backed by genuine market force. The Volume Power System teaches you to demand volume confirmation, transforming this classic pattern into a reliable and high-conviction component of your trading strategy.

Stop hoping for reversals. Start identifying them with the irrefutable evidence that volume provides.

Ready to master the art of identifying true candlestick reversals and trade with the confidence of the Smart Money?

GET YOUR COPY OF « VOLUME POWER SYSTEM » NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.