Ever watch a stock push to a new high on what looks like massive volume, only to see it get smacked down and reverse in the blink of an eye? It’s one of the most frustrating things in trading. You follow the textbook rules— »volume confirms the trend »—but you still get caught on the wrong side. The reason is that you’re missing the hidden context: the crucial battle between aggressive vs. passive volume. The truth is, not all volume is created equal.

The number you see at the bottom of your chart is just a headline. The real story, the juicy gossip of the market, is hidden in how that volume was traded. This is the silent battle between aggressive vs. passive volume, and learning to read it is like gaining a superpower.

So, What’s the Big Deal with Volume Anyway?

Before we dive deep, let’s get on the same page. Traditional volume is simply the total number of shares or contracts that changed hands over a specific period. A big green volume bar means lots of trading happened as the price went up. Simple, right?

Kind of. But it’s like saying a football game was « high-scoring » without knowing which team scored the points or how they did it. Was it a desperate last-minute Hail Mary or a methodical, unstoppable drive down the field?

That’s where the two types of volume players come in.

Meet the Players: The Patient vs. The Impatient

Imagine a bustling farmers’ market. You have two kinds of people.

1. Passive Players (The « Stall Owners »)

These are the sellers who set up their stall, arrange their apples, and put up a price sign. They say, « My apples are $1 each. If you want them, come to me. »

In the market, these are traders who use limit orders. They place their bids (to buy) or asks (to sell) on the order book and wait. They are providing liquidity to the market. They are patient. They are not chasing the price; they are letting the price come to them.

Passive Volume is the volume that gets filled when an aggressive trader comes and takes their resting orders.

2. Aggressive Players (The « Shoppers in a Hurry »)

Now imagine someone running into that same market yelling, « I NEED APPLES NOW! I’ll pay whatever the going rate is! » They don’t want to wait. They run to the nearest stall and buy all the apples at the listed price.

In the market, these are traders who use market orders. They are saying, « Give me the best price available right now. » They are taking liquidity from the order book. They are impatient and create a sense of urgency.

Aggressive Volume is the volume generated by these market orders. This is the volume that actually moves the price up or down by crossing the bid-ask spread.

For a deeper dive into the mechanics of different order types, this article from Investopedia is a fantastic resource: Market Order vs. Limit Order: What’s the Difference?.

How to « See » the Battle: Tools for Reading Order Flow

Okay, so how do you actually see this on your charts? You can’t with a standard volume indicator. You need tools that look inside the trading activity, often called order flow or tape reading tools.

The most powerful and easy-to-understand tool for this is the Cumulative Volume Delta (CVD).

Don’t let the fancy name scare you. It’s simple:

CVD = Aggressive Buy Volume – Aggressive Sell Volume

It’s a running total that shows you which side is being more aggressive.

- If CVD is rising: Aggressive buyers are in control. They are hitting the « buy at market » button more than sellers are hitting the « sell at market » button.

- If CVD is falling: Aggressive sellers are in control. They are dumping their shares at market prices.

Aggressive vs. Passive Volume – The Secret Sauce: Finding Divergences and Absorption

This is where you gain your edge. When price and CVD move together, it confirms the move. But when they disagree… that’s when things get interesting.

Aggressive vs. Passive Volume – Scenario 1: The Reversal at the Top (Absorption)

Look at the chart above. The price pushes to a new high, and a typical trader might jump in, thinking it’s a breakout.

But look at the CVD. It’s flat or even pointing down!

What does this mean? It means that despite a flood of aggressive buyers trying to push the price up, there are massive, invisible walls of passive sellers absorbing all that buying pressure. The « stall owners » are restocking their apples as fast as the « shoppers in a hurry » can buy them.

This is called absorption, and it’s often a dead giveaway that the move is running out of steam and a reversal is likely.

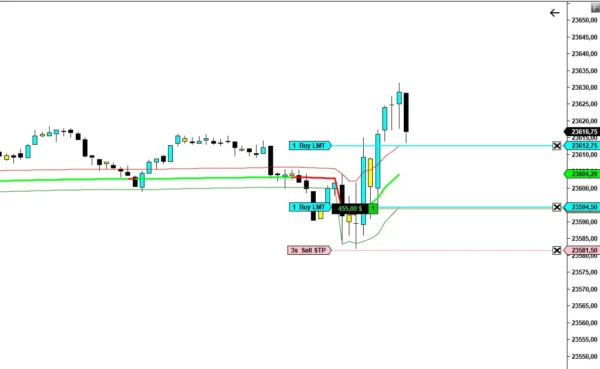

Aggressive vs. Passive Volume – Scenario 2: The Breakout Confirmation

Now, let’s flip it. Imagine the price is trying to break out of a range.

- Weak Breakout: Price inches up, but the CVD is barely moving. This signals a lack of aggressive conviction. It’s likely to fail.

- Strong Breakout: Price screams upward, AND the CVD is rocketing up with it. This confirms that urgent, aggressive buyers are in complete control. This is the kind of breakout you want to be a part of.

Understanding this dynamic is at the core of our approach. We’ve built the Volume Power System around interpreting these exact clues the market leaves behind.

Aggressive vs. Passive Volume – Why This Matters More Than Ever

In today’s markets, dominated by high-frequency trading (HFT) and algorithms, this analysis is critical. These algorithms are masters of liquidity and order flow. They are the biggest « stall owners » and the quickest « shoppers. » By learning to read aggressive vs. passive volume, you’re essentially looking over their shoulder.

As explained by the professionals at the CME Group, understanding this market microstructure is no longer optional for serious traders. You can explore more on their educational hub: CME Group Education.

The Takeaway: Stop Reading Headlines, Start Reading the Story

Volume isn’t just a number; it’s a story of conflict. It’s the urgent, price-moving force of aggressive traders clashing with the patient, price-absorbing force of passive traders.

By moving beyond simple volume bars and using tools like Cumulative Volume Delta, you can:

- Confirm the strength of a trend.

- Spot exhaustion and potential reversals before they happen.

- Avoid false breakouts that trap other traders.

It’s the closest you can get to reading the market’s mind.

GET YOUR COPY OF “VOLUME POWER SYSTEM” NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.