The Problem: Why Standard VWAPs Fail in Volatile Markets

Every professional trader knows the Volume-Weighted Average Price (VWAP) is a critical tool for gauging fair value. But traditional VWAPs have a fundamental flaw: they are static. They start calculating at an arbitrary point (usually the session open) and can be heavily distorted by low-volume periods, giving you a lagging and often misleading view of the market.

In a fast-moving market, the « fair value » isn’t determined by the opening bell; it’s forged in the fires of high-volume battles. How can you be confident in your analysis when your most important tool ignores the very moments that define the session?

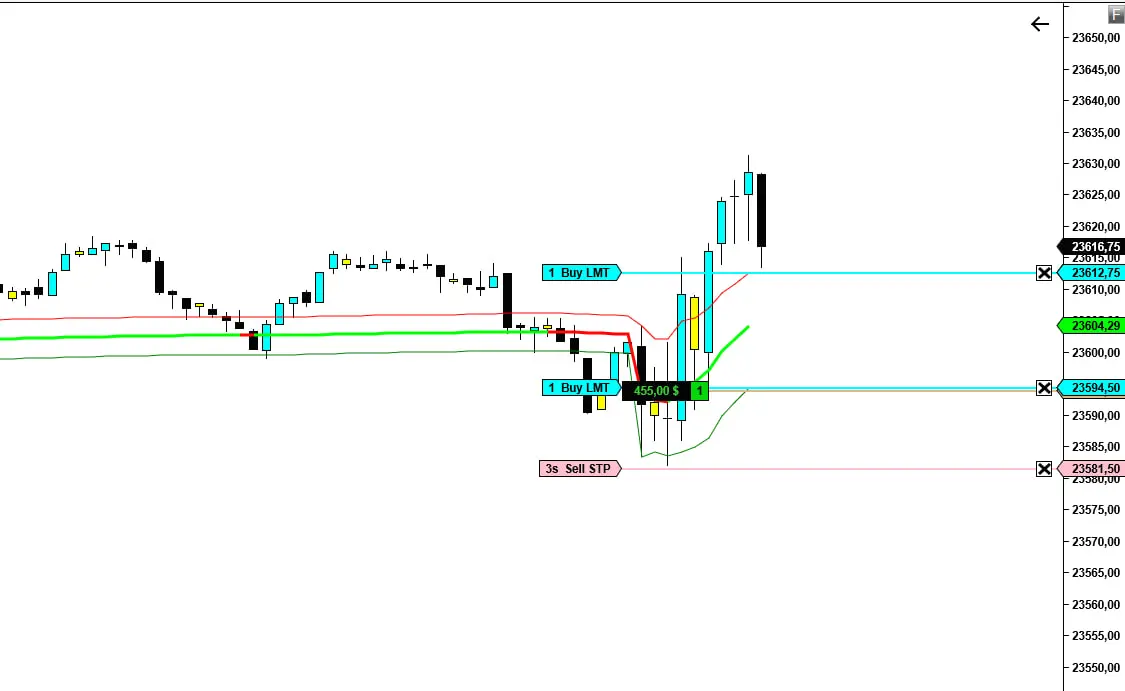

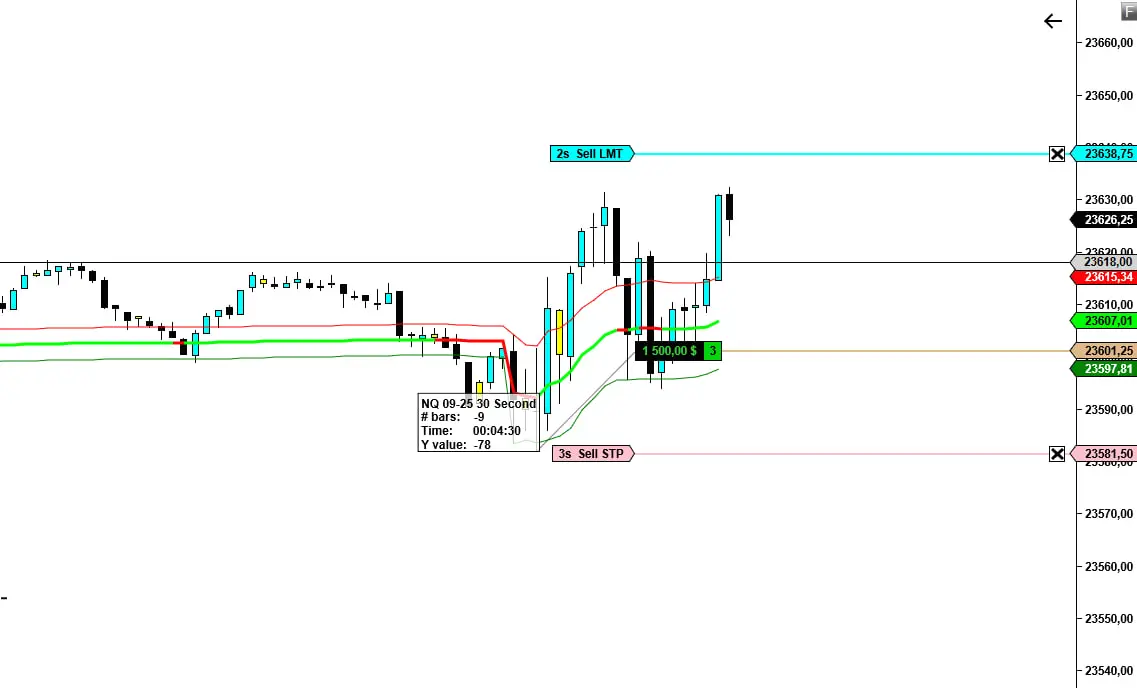

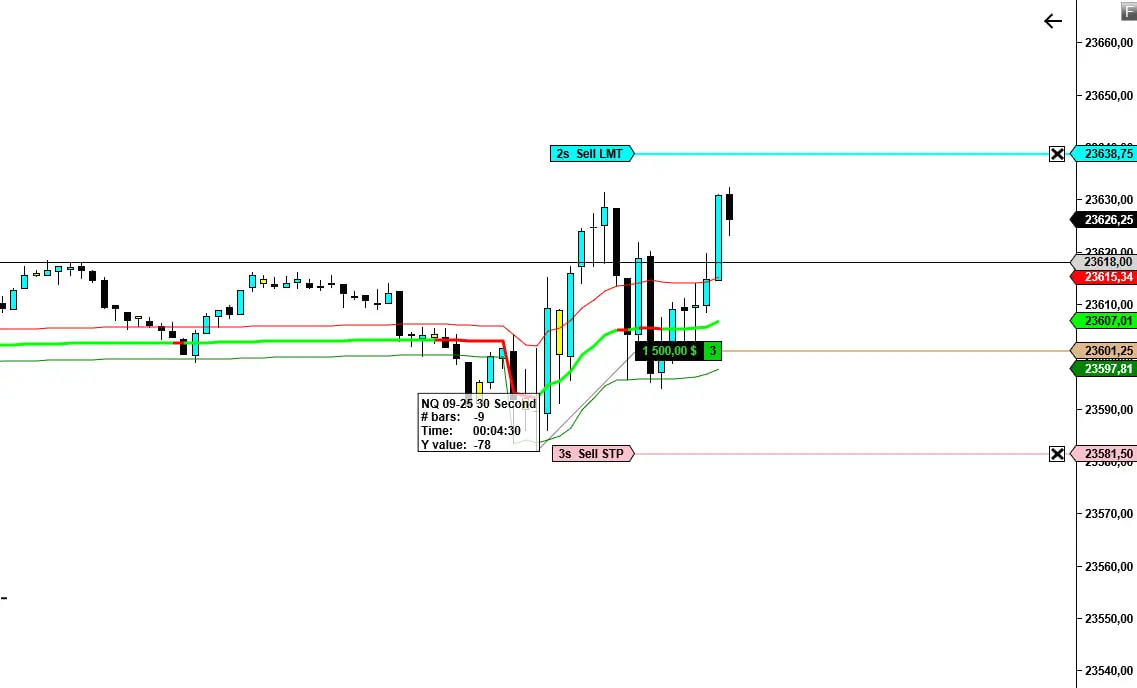

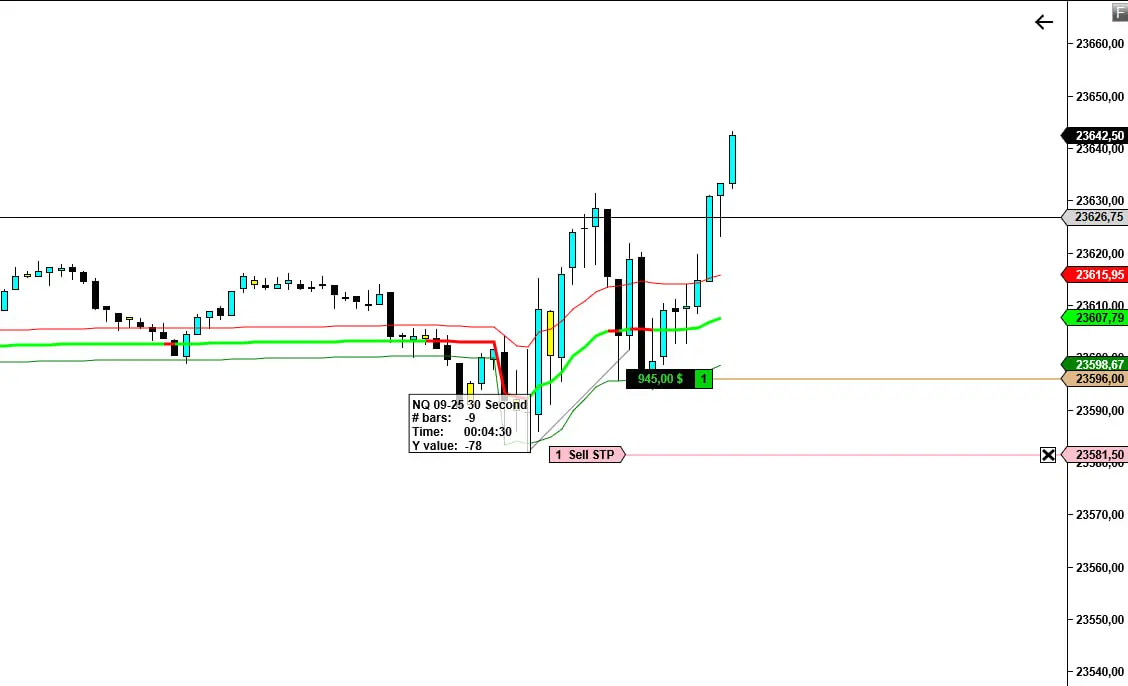

The Solution: VPS Dynamic VWAP – Anchored to Conviction

The VPS Dynamic VWAP revolutionizes this concept. Instead of starting at a fixed time, our proprietary algorithm constantly scans the session for the point of maximum conviction—the single bar with the highest trading volume—and automatically anchors all its calculations from that critical moment.

This means your VWAP is always centered on the market’s true center of gravity, the price level where the most significant business was conducted. It’s a dynamic, intelligent VWAP that adapts to what the market is doing right now.

But we didn’t stop there.

Key Features & Benefits: What Makes the VPS Dynamic VWAP a Game-Changer

-

Dynamic High-Volume Anchor: Forget session-start VWAPs. Our indicator automatically finds the bar with the highest volume and anchors its calculations there, providing a far more relevant measure of the session’s true « fair value. »

-

HVWAP & LVWAP Value Channels: This is not your standard indicator. We’ve included two additional proprietary bands: the High-Volume Weighted Average Price (HVWAP) and the Low-Volume Weighted Average Price (LVWAP). These bands create a powerful « value channel » that acts as dynamic support and resistance, showing you the upper and lower boundaries of where institutions are likely trading.

-

Asymmetrical Deviation Bands for Precision: Standard deviation bands are useful, but ours are smarter. The upper bands are calculated from the HVWAP (resistance), and the lower bands are calculated from the LVWAP (support). This creates an asymmetrical and far more accurate visual of market extremes and potential mean-reversion zones.

-

Fully Customizable Visuals: Take full control of your charting. Customize the colors, widths, and multipliers for the central VWAP and all deviation bands to fit your unique trading style and visual preferences.

-

Clear Session Time Control: Easily define your active trading session to ensure the indicator focuses only on the periods that matter to you, filtering out overnight noise.

Who Is This For?

The VPS Dynamic VWAP is designed for the serious trader who demands a professional edge. It’s ideal for:

-

Day traders and scalpers who need a precise, real-time measure of intraday value.

-

Traders who use mean-reversion or trend-following strategies.

-

Users of the Volume Power System who want the official tool to complement the methodology taught in the book.

What You Will Receive:

-

The VPS Dynamic VWAP indicator file for the NinjaTrader 8 platform.

-

A comprehensive installation guide and user manual (PDF).

- A lifetime license for use on up to two machines.

- Access to all future updates for version 3.x.

Prerequisites:

-

A valid license for the NinjaTrader 8 trading platform.

-

A real-time or historical data feed that includes volume.

Stop trading with lagging information. Anchor your decisions to the market’s true center of gravity and see the markets with the clarity of an institution.

Add the VPS Dynamic VWAP to your arsenal today and gain the professional’s edge.