As seasoned traders, we’ve all been taught the fundamentals: price action defines trends, support and resistance levels are crucial, and candlestick patterns whisper tales of market sentiment. But what if there’s a deeper layer to market understanding, a layer that reveals not just what the price is doing, but why it’s doing it, and crucially, who is behind the move?

This deeper insight lies in volume analysis. While often relegated to a secondary indicator, understanding volume is paramount to unlocking hidden market intent and gaining a true edge in the complex world of futures trading and stocks trading. It’s the energy that drives the price, the footprint of institutional participation, and the ultimate confirmation of conviction.

Why Volume is More Than Just a Bar Chart

Many traders glance at the volume histogram at the bottom of their charts and note whether it’s « high » or « low. » But true volume analysis goes far beyond this cursory observation. Volume represents the number of contracts or shares traded within a given period, essentially measuring the level of participation and conviction behind a price move.

- Price action tells you the outcome of the battle.

- Volume tells you the intensity and the players involved in that battle.

A strong price move on low volume might be a « phantom » move, easily reversed. The same move on surging volume, however, signifies strong commitment and a higher probability of continuation. This distinction is vital for professionals seeking precision.

The Core Principles of Advanced Volume Analysis for Market Intent

Moving « beyond the basics » means understanding the nuances of volume interaction with price. The Volume Power System (VPS), detailed in my book, leverages these precise interactions:

- Volume Confirmation of Trends:

- Healthy Uptrend: Price advances should be accompanied by strong, rising volume. This indicates increasing buying conviction and active participation from the demand side. Pullbacks within an uptrend should ideally occur on declining volume, showing a lack of selling pressure.

- Healthy Downtrend: Price declines should see increasing volume, signaling aggressive selling and institutional distribution. Rallies within a downtrend should be on low volume, indicating weak buying interest.

- Volume Divergences: Early Warning Signals:

- This is where volume analysis truly shines in identifying hidden market intent.

- Bullish Divergence: If price makes new lows, but volume on those lows is significantly lower than previous lows, it suggests selling pressure is exhausted. The bears are losing steam, even if price is still dropping. This is a subtle signal that smart money might be accumulating.

- Bearish Divergence: When price makes new highs, but the volume on those highs is decreasing, it indicates that fewer participants are willing to buy at higher prices. The bulls are tiring. This often precedes a reversal or significant correction.

- Volume in Consolidation & Breakouts:

- Consolidation (Ranges): Periods of price consolidation should typically exhibit low or decreasing volume. This shows indecision and a balance between supply and demand.

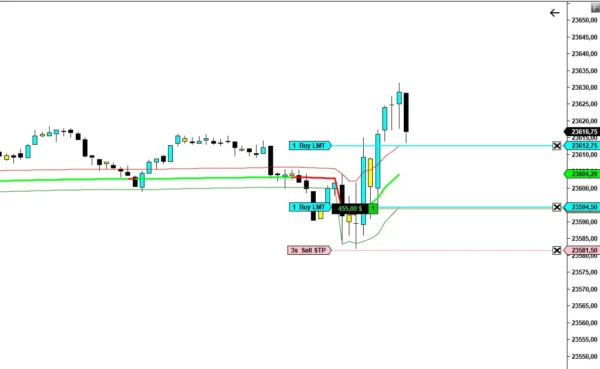

- Breakouts: A valid breakout from a consolidation pattern should be accompanied by a significant surge in volume. This surge confirms the conviction of participants pushing the price out of the range, increasing the probability of a sustainable trend. A breakout on low volume, however, is a strong warning sign of a potential false breakout or « volume trap. »

- Climax Volume: Spotting Exhaustion:

- Extremely high volume at the end of a prolonged trend often signals exhaustion.

- Buying Climax: A massive spike in volume on an aggressive upward move, often forming a large candlestick (like a Marubozu or one with a long upper wick). This can indicate the last surge of buyers (often retail traders caught in FOMO) as smart money quietly distributes their positions.

- Selling Climax (Capitulation): A huge volume spike during a sharp downtrend, often associated with panic selling. This typically marks a bottom, as weak hands sell out and professional buyers absorb the overwhelming supply.

- Absorption Volume (Advanced Concept):

- Sometimes, prices barely move despite very high volume. This can be absorption. If volume is high but price isn’t advancing significantly in an uptrend, it suggests there’s a strong seller absorbing all the buying interest. Conversely, in a downtrend, high volume with minimal price decline could indicate strong buyers absorbing selling pressure. This reveals hidden strength or weakness at specific price levels, hinting at institutional activity.

Unlocking Market Intent: What Volume Really Tells You

By meticulously analyzing these volume dynamics in conjunction with candlestick patterns and price action, traders can gain profound insights into:

- The presence of « Smart Money »: Large institutional players cannot hide their trades. Their activity leaves distinct volume footprints. Learning to read these clues allows you to trade alongside them, not against them.

- True Supply and Demand Shifts: Volume acts as a barometer for the underlying balance. Surging volume on rallies indicates strong demand overwhelming supply, while high volume on declines signifies supply dominance.

- Validation of Price Patterns: A classic candlestick reversal pattern gains immense credibility when confirmed by specific volume conditions. The same pattern without volume confirmation can be a trap.

- Anticipating Future Moves: Volume often provides early warnings of potential reversals or confirmations of continuation before they become overtly obvious on price charts alone. It helps you « see » the market’s inner workings.

Implementing Volume Analysis: The Volume Power System Advantage

At Volume Power System (VPS), we believe that understanding the confluence of price action and volume is not just an advantage – it’s a necessity for consistent profitability. My book, « Volume Power System: Revolutionize Your Trading: The Infallible Strategy Based on the True Market Force, » dives deep into these principles.

It’s a comprehensive guide for experienced traders looking to integrate an order flow and volume profile informed approach, moving beyond superficial analysis to truly institutional trading signals. You’ll learn the precise setups, risk management rules, and psychological discipline needed to transform your trading performance.

Ready to master the true language of the market?

Stop guessing and start trading with genuine market conviction. The Volume Power System will change the way you look at charts forever.

GET YOUR COPY OF « VOLUME POWER SYSTEM » NOW!

-

Volume Power System VE

Le prix initial était : $ 250,00.$ 199,00Le prix actuel est : $ 199,00. -

VPS Conviction Monitor: Instantly Spot Institutional Activity and Market Turning Points

Le prix initial était : $ 90,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Dynamic VWAP: The Professional’s Edge for Identifying True Market Value

Le prix initial était : $ 100,00.$ 57,00Le prix actuel est : $ 57,00. -

VPS Ignition Zone: The Ultimate System for Pinpointing High-Precision Entries & Exits

Le prix initial était : $ 80,00.$ 47,00Le prix actuel est : $ 47,00.